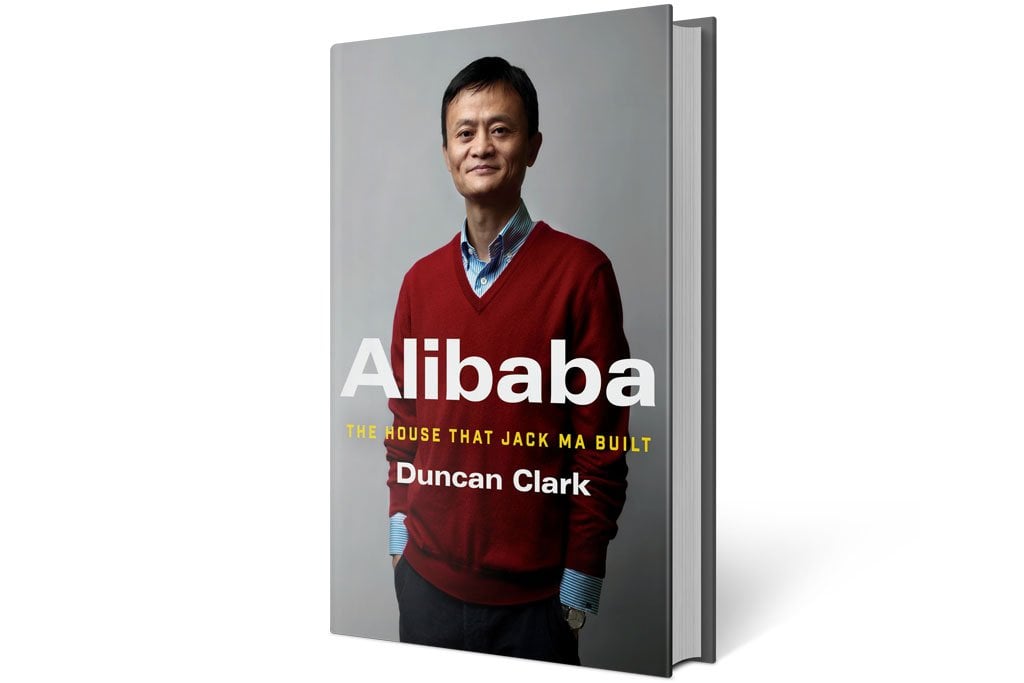

Alibaba founder and CEO Jack Ma has become an international business icon. For many, he represents the potential of capitalism in China, the triumph of the little guy over adversity and the power of technology to transform the world. But he also is a bit of an enigma—a master storyteller with a keen ability to create his own reality, à la Steve Jobs’ famous “reality distortion field”—few can truly be said to know Ma or his motivations. Duncan Clark, who founded investment advisor BDA China in Beijing in 1994 has known Ma since Alibaba was little more than an idea, and in his new book Alibaba: The House That Jack Ma Built, he explores the origins and growth of the company and seeks to understand Ma the man. We spoke with Clark about his take on Ma and Alibaba.

Q: JACK MA IS AN INTERESTING GUY. YOU’VE KNOWN HIM A LONG TIME, AND YOU’VE SEEN ALIBABA DEVELOP FROM THE VERY BEGINNING. WHY DID YOU DECIDE TO WRITE THIS BOOK NOW?

The IPO brought Alibaba to the attention of retail investors. The institutional investors had known him for some time. People also knew Jack’s story. That surprised me. People identified with his struggle. He’s not very tall; he came from poverty and was an English teacher. I was at a real estate convention in Shanghai, and this broker from Seattle said, “Oh, Jack Ma, he’s my idol.” That was two or three years ago. He resonates. I also wanted to delve in because we’d all seen the recycled stories. And he is a storyteller.

DID YOU STRUGGLE WITH SEPARATING THE IDENTITY OF THE MAN FROM THE IDENTITY OF THE COMPANY?

I’m not sure you can talk about the company separate from Jack Ma, but I do think you can talk about Jack Ma separate from the company. When Jack stepped down as CEO, nobody was listening to his replacement, Jonathan Lu. Actually he only lasted a very short time in the job. How do you fill those boots?

SO IS IT A LITTLE BIT LIKE STEVE JOBS AND APPLE?

It’s the same with the stories coming out about Jobs and Apple. How could you conceive of this company without him? I don’t think you can in terms of the history. Of course, going into the future you have to conceive of the company without its founder. There’s a saying: “A cult dies with its founder, but a religion outlives him.” I think they’re trying to become a religion… [Ma] is the conductor of a pretty large orchestra. Yet the string section is so big now—Ant Financial Group, that’s a tens-of-billions-of-dollar financial group.

YEAH, FINANCIAL SERVICES IS A HUGE PART OF THEIR BUSINESS NOW. I KEEP HAVING THIS FEELING THAT MA AND WHAT HE’S CREATED IS PERHAPS THE MODEL FOR A CAPITALIST FUTURE IN CHINA, ALMOST IN OPPOSITION TO WHAT THE GOVERNMENT WANTS.

He’s playing really a global game. That’s why he resonates. He speaks English; he’s a good storyteller; he sounds familiar. It’s kind of the American Dream in China. We do have to take a step back, as I do think we invest in him the hopes of the China we’d like to see. Frankly, as we dig into it, if you look at some of the Ali Finance transactions and asset transfer and how he deals with the government, it’s messy on the inside. You don’t want to see how the sausage gets made. But he represents the soft power that China’s government craves.

SO HE’S NOT NECESSARILY A MODEL THAT CAN BE RECREATED.

He is an intriguing prism into what could be China’s future. How we get there from here, I’m not sure he knows. It’s a very interesting dance between him and the government. I wouldn’t characterize the government as completely not always pragmatic; they see the utility of people like Jack to the party.

YOU WERE AN EARLY ADVISOR TO MA, AND YOU ACTUALLY PASSED ON AN OPPORTUNITY TO BUY-IN EARLY ON. WHAT HAS IT BEEN LIKE WATCHING THE TRAJECTORY OF THE COMPANY?

There’s a sense of incredulity that someone like this could build this or even follow-up on his vision. When he spoke, his visions were basically delusional. [But] he doesn’t have airs. He was always pretty modest. He’d drive you to lunch and stay in cheap hotels. It was always an interesting contrast between grandiose ambitions and personal modesty. That was pretty unusual in China. Your BS-detector was always in the red zone in those early days. There was a lot of copying, and they were basically just doing what had already been done in the West.

THE LAST THING I WANT TO TOUCH ON IS THE SOUTH CHINA MORNING POST ACQUISITION. IS THAT POLITICALLY MOTIVATED? IS HE PLANNING ON USING IT AS A TOOL?

The currents run very deep in Hong Kong at the moment. We’re almost 20 years into the 50-year transition from the UK to it becoming fully a part of China. It’s a very febrile atmosphere. We had Occupy-style protests last year in the streets. To walk into that and buy an influential newspaper—it isn’t the largest in the sense that it’s an English language newspaper, and the Cantonese language papers are bigger, but actually in terms of Hong Kong’s image—it is important.

HE WOULDN’T BE THE FIRST BILLIONAIRE TO BUY A PAPER. JEFF BEZOS JUST BOUGHT THE WASHINGTON POST, FOR INSTANCE.

Unlike Bezos, this was Alibaba buying it. It wasn’t Jack’s personal purchase. There’s a difference there. There’s some argument to say that they may do a better job than the previous owners. But it’s interesting that he chose to do that. Or did he choose? Some people are speculating that he was asked by Beijing to help. You get into these murky things. He obviously has to make nice with the government to some degree. But obviously, if he’s co-opted to the sense that he loses control of what he’s doing, that’s not going to help him in the long run. My joke was that he bought—twice—the most expensive house in Hong Kong, so he’s going to have the paper delivered. So that’s the mogulness.

BUT THERE IS THIS SPECTER THAT THIS IS A MOVE TOWARDS GOVERNMENT CONTROL OF THE PRESS IN HONG KONG.

Others say, no, he’s part of the crackdown. It’s a very, very divided atmosphere there. Joe Tsai used to comment that “what’s good for Alibaba is good for China”—you know, like the GM quote. In a way you, can see the frustration among entrepreneurs that the government is pretty bad at communicating messages. It doesn’t have the right fonts, or it’s badly produced, or it just doesn’t have the right message. These guys, because they’re talking to Wall Street and winning customers, they are representing what we hope China might be. So they kind of step in. Are they doing that to help themselves? I don’t think we’re going to see Alibaba references in the South China Morning Post. But I do think you’re right, the broader theme about China and the world [will be there]. China is an emotive topic. In England we say it’s like marmite. Either you like it or you hate it. But it certainly is relevant.

Ecco, an imprint of HarperCollins Publishers, April 2016, $28, 304 pages. More information here.