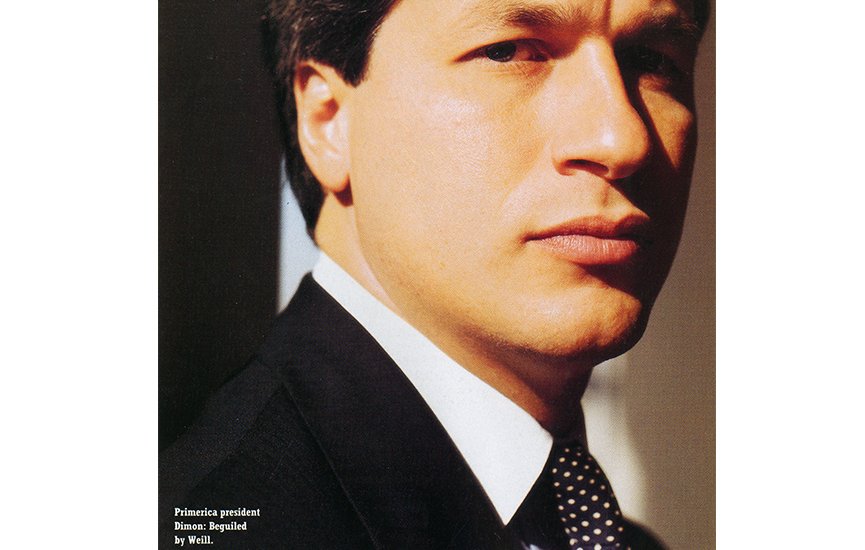

Worth profiled a young Jamie Dimon in its February–March 1992 inaugural issue. At the time Dimon was the newly appointed president of Primerica, and he would go on to help build Citigroup and later become president and CEO of JPMorgan Chase in the mid 2000s. Dimon has earned a coveted spot on Worth’s Power 100 list for a number of years, most recently ranking as number 22 in 2016.

Jamie Dimon began life with certain advantages. He was born into a wealthy New York family. His father and grandfather were stockbrokers. Provided he had a head for numbers (he did), a job on Wall Street was a shoo-in.

Still, he didn’t leave things to chance: For one of his economics papers at college, Dimon analyzed the 1974 merger of Shearson Hamill, his father’s firm, with Hayden Stone, led by Sandy Weill. Dimon’s was a flattering appraisal; he applauded the deal’s synergies. But it was his mother’s idea to bring a copy of the paper to a company cocktail party to present it to Mr. Weill. Mothers are like that.

The result: a summer job and a permanent association.

In 1982, when Dimon was about to graduate from Harvard Business School, Weill asked him to become his personal assistant at American Express. When Weill resigned from AmEx in 1985, Dimon went along (“I couldn’t imagine staying without him”). Following several false starts—Weill wanted to acquire a company to manage—the pair hit pay dirt with Commercial Credit Co., an ailing unit of Control Data.

In 1986, they took 80 percent of Commercial Credit public, the third largest IPO at the time. Over the next year, Weill sold off $1 billion of Commercial Credit’s assets and pushed the stock to $33 per share. With the proceeds, he snapped up Primerica Corp. and its subsidiary, Smith Barney. Dimon helped determine the value of these companies and earned himself the title of executive vice president and chief financial officer of Primerica.

Last September, Weill appointed Dimon, 35, president of the huge—and healthy—financial services company, thereby raising a prickly question: Is Dimon brilliant or lucky? Whatever he is, he’s shrewd.

“The most important thing in life,” he observed when Weill tapped him at Harvard, “is who you work for, not what you do.” It’s proven a profitable strategy.

But when Batman retires, will Robin call the shots? Primerica is brimming with heavyweight executive talent, men 20 years his senior. Dimon plays it coy: “No matter how much you think you know, you can always use others’ input. A good team can do better than a one-man band.”—Nancy Marx Better

Reprinted from the February-March 1992 issue of Worth