Fears of inflation, global recession, the COVID pandemic, and a brutal land war in Europe dominated international headlines in 2022. Nevertheless, last year was a record-setting year for the fine-art market.

Of the three largest international auction houses—Christie’s, Sotheby’s, and Phillip—it was Christie’s that reached the highest mark by selling $8.4 billion in art, which according to the auction house, was up 17 percent from 2021 and is the largest annual total in the history of the fine-art market. But it’s not the only record Christie’s set. Last year, it also auctioned off the most valuable 20th-century work of art—“Shot Sage Blue Marilyn,” by Andy Warhol, which fetched $195 million. Christie’s said it was also the second-highest price any artwork has ever achieved at an auction.

On the face of it, Sotheby’s seemed to do well, too—$7.7 billion in sales. However, this figure included roughly $1 billion in real estate and car auctions, which meant sales from fine art and collectibles were $6.8 billion, down 7 percent for 2022. But Phillips, the smallest of the three houses, did well, up for the year to $1.3 billion from $1.2 billion.

While the record year may have baffled some, others found the competition to own blue-chip works of art made perfect sense. Charles F. Stewart, Sotheby’s CEO, told Barron’s: “The flight to quality in 2022 led to sustained demand for blue-chip masterpieces…” In other words, buyers were, in fact, worried over those headline fears, and choose to buy “quality” or fine-art works that were safe bets, and not risky.

Several single-owner sales helped push Christie’s sales to its record-setting $8.4 billion. By far, the most notable of these auctions was the landmark sale of Paul G. Allen’s collection, the co-founder of Microsoft, which sold for $1.62 billion in November, setting a new record for a single-owner collection. Unlike some collections, which tended to focus on one particular era, Paul G. Allen’s collection included a variety of works, from French Impressionists to American Modernists, as well as artists from other periods, including the Early Renaissance.

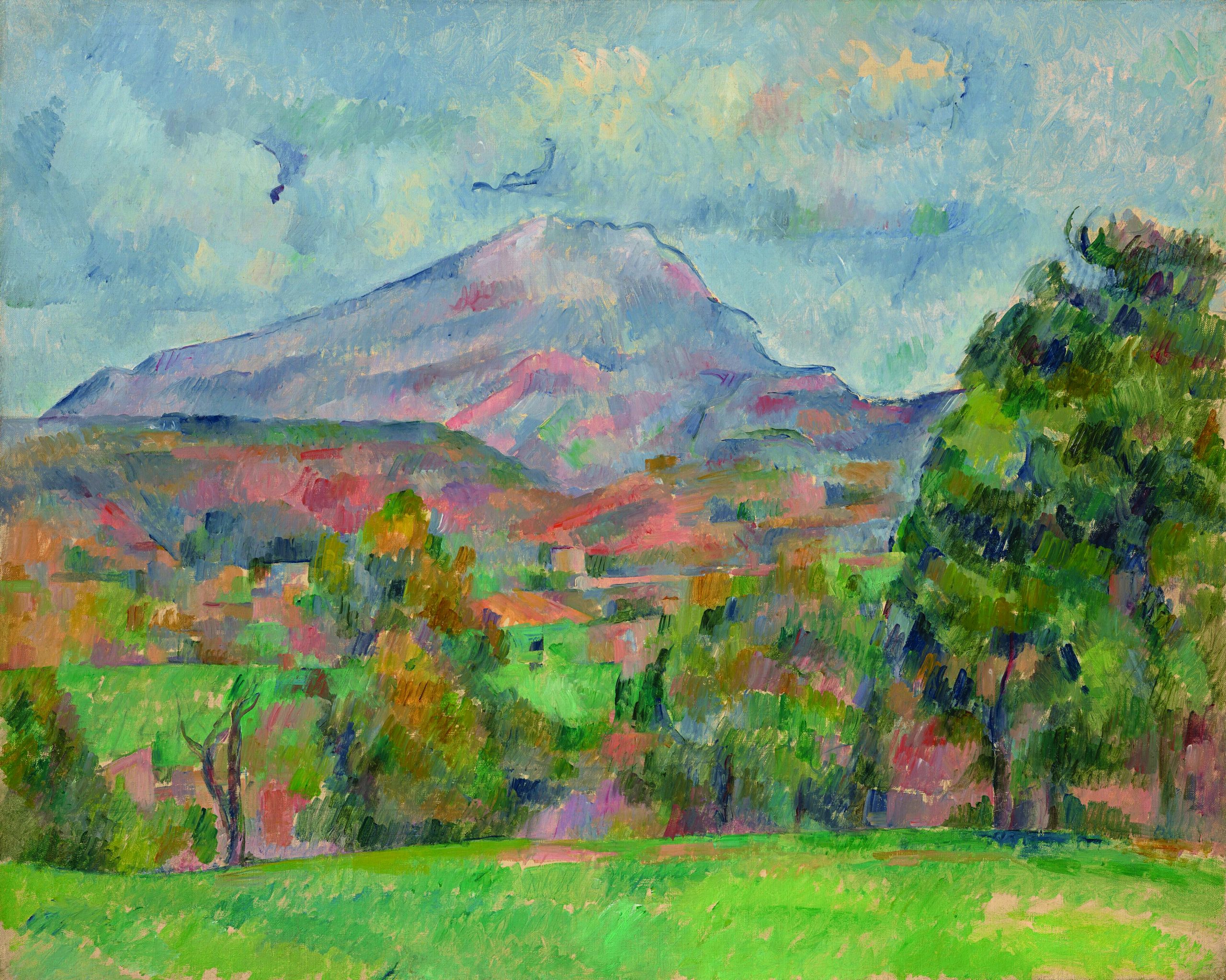

Christie’s noted that another surprising outcome from this particular sale was that it included five paintings that sold for more than $100 million, including “Models, Ensemble (Small Version),” a gorgeous figurative painting of three nudes by Georges Seurat, which fetched $149.2 million, and “La Montagne Sainte-Victoire,” a landscape by Paul Cézanne, in his signature style, which sold for $137.8 million. There were other very prominent painters in the collection, as well, not just Post Impressionists, including Early Renaissance painter Sandro Botticelli, American realist Andrew Wyeth, English Romantic painter J. M. W. Turner, Austrian symbolist painter Gustav Klimt, and American modernist painter, Georgia O’Keeffe. It even sold the astonishing “Large Interior, W11 (after Watteau),” a painting from 1981-83, by the renowned British realist Lucian Freud.

The Paul G. Allen auction eclipsed the previous record sale of Harry and Linda Macklowe, which went for $922 million just a few months earlier, in May 2022. There were other prominent single-owner collection sales in 2022, including the sale of the Ann and Gordon Getty collection and the Hubert De Givenchy sale.

Although these sales figures are impressive, there were other intriguing trends in the fine-art market in 2022. The industry embraced online sales, which meant both online auctions and auction bids were up. Plus, many of those looking to buy fine art were from Asia. But perhaps the most encouraging trend to gain momentum in 2022 was that previously underappreciated artists, both past and present, were getting noticed and generating significant sales. For instance, Christie’s, in its yearly report, noted there were “strong prices for works by female artists,” including Bridget Riley and Yayoi Kusama. Contemporary female painters, like Elizabeth Peyton and Lisa Yuskavage, also did well.

There was a renewed, even heightened interest in Black artists in 2022, sparked by the sale of “The Sugar Shack,” an iconic painting from Ernie Barnes, which he completed in 1976. The picture had a conservative estimate of $200,000 but sold at Christie’s for a whopping $15.3 million.

In Bank of America’s fall 2022 report on the fine-art market, when asked about the impact of the sale of Ernie Barnes, the report said, “we can expect to see more Ernie Barnes paintings coming to market… A result like this recalibrates the market for an entire genre and generation of Black artists beyond Barnes alone. Collectors are looking back in history to discover older or recently deceased artists previously overlooked by the market and institutions—including artists such as Jacob Lawrence, Romare Bearden, Charles White, Faith Ringgold, and Hedda Sterne.”

Lastly, interest in sales for NFTs, which seemed on track to remake the fine-art market in 2021, particularly with the sale of Beeple’s “Everydays: The First 5000 Days,” which sold for $69.3 million Christie’s that same year, went down dramatically. In part, this was due to continued turmoil in the cryptocurrency world, such as the collapse of FTX and other companies.

This past December, Bloomberg reported NFT sales had dropped to a 16-month low, stating, “almost a year after the nonfungible token (NFT) frenzy crested, demand for the digital certificates of ownership has evaporated. Sales have dropped to the lowest level since July 2021.” We’ll be sure to keep an eye out on the NFT market to see if it can emerge from what’s looking like a long, and particularly frigid crypto winter.