As retirement approaches, individuals attempt to understand how much money they will need to satisfy their living expenses. Many believe they must reach a certain threshold of savings before they feel comfortable entering retirement.

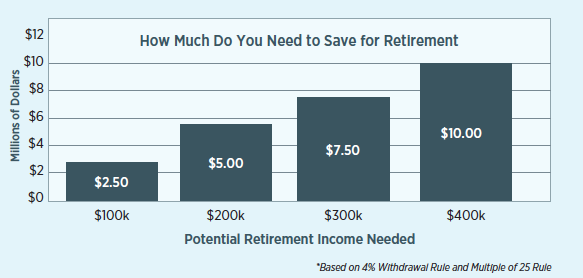

The conventional wisdom is to look at the “Multiply by 25” rule, or the “4 Percent Rule”:

- Multiply by 25 Rule: Estimate the necessary savings amount by looking at the expected annual spending in retirement, and multiply that number by 25.

- 4 Percent Rule: Estimate the amount that could be withdrawn annually from the portfolio in retirement in order to help make it last.

- Multiply by 25 Rule Example: If the objective is to withdraw $100,000 per year from the investment portfolio, an individual would need $2.5 million dollars ($100k x 25 = $2.5 million).

- 4 Percent Rule Example: If an individual has an investment portfolio of $2.5 million, he or she could withdraw $100,000 per year ($2.5 million x 4 percent = $100,000).

What are some complications with these approaches?

These rules of thumb may be helpful in providing general estimates; however, they do not take into account a number of important factors:

Investment Approach: Depending on the asset allocation, expected long-term returns will vary and impact the ability to generate income and appreciation. For example, an individual with an extremely conservative investment strategy (mostly cash and short-term investment bonds) may want to consider a more conservative draw-down (2 percent or 3 percent), given the potentially lower expectation on investment return.

Sequence of Investment Returns: In addition to long-term expected returns, the timing of the returns also impacts an individual’s investment portfolio in retirement. When the draw-down begins from a portfolio, the returns during the first few years may have a substantial impact on the portfolio’s potential to generate future income. If there is a market downturn at the start of an individual’s retirement as opposed to at the end, the individual who experiences a market decline at the beginning will likely generate less income over the course of he or she retirement (even if the long-term returns are the same).

Other Sources of Income: Pensions, social security, annuities, rental income, etc. can supplement a substantial portion of retirement income.

Estate-Planning Objectives: Considerations for gifting, charitable donations and inheritances may impact retirement.

Adult Children and Parent Assistance: It has become more common for a portion of an individual’s income to go toward assisting other family members.

Healthcare Cost: One of the largest retirement expenses will likely be the cost of health care. Individuals with different levels of health care plans, long-term care options and life insurance policies will all have a different impact on retirement planning.

Taxes: The amount being withdrawn will have different tax consequences and different draw-down implications, depending on the account structure of the investment portfolio (how much money is in pre-tax, Roth or taxable brokerage accounts).

What should you consider?

Retirement planning can be complex and may require a more thorough analysis of the overall financial picture.

It may be beneficial to start with a reasonable or conservative withdrawal rate and take some time to review the impact on your overall retirement portfolio. Over time, adjustments will likely become necessary. Taking the time to re-evaluate the amount and account types from which distributions occur may help prolong retirement income.

Keep in mind, the sequence of investment returns is extremely important when you’re determining the ability to draw down a portfolio. Working with a financial advisor to ensure you have a sound strategy that provides both confidence and security can help provide a great deal of peace of mind.