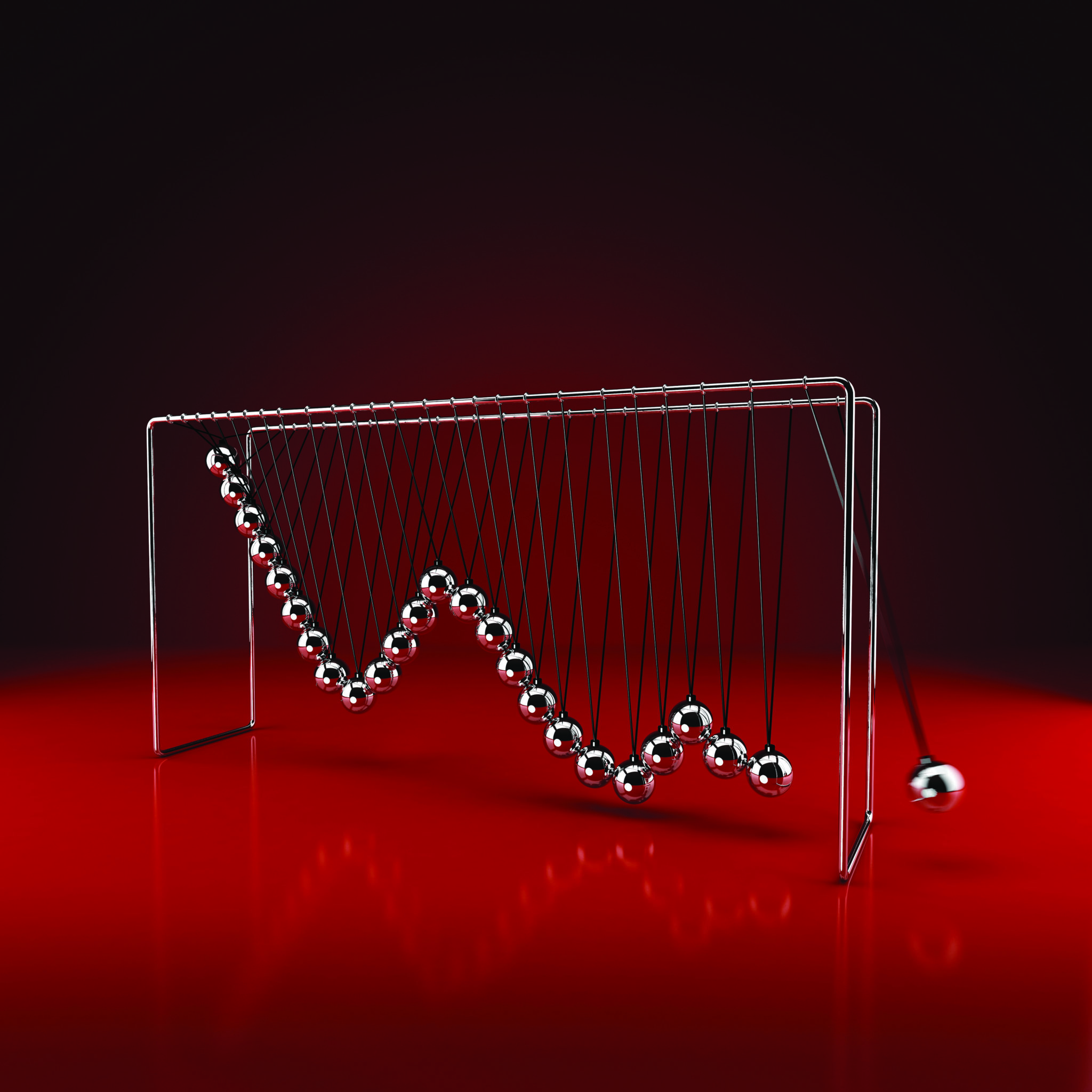

After a prolonged period of zero percent short-term interest rates, the Federal Reserve has raised the federal funds target interest rate seven times to 2 percent as of the writing of this article. Previously, the Fed cut interest rates 10 times, bottoming out in December 2008, to respond to the Great Recession of 2008–09. The Fed then waited seven years to make the first subsequent increase, up from zero, in December 2015.

The federal funds rate is the interest rate banks charge one another to lend reserve funds overnight. These funds allow banks to maintain the Federal Reserve requirement, which helps ensure that they can accommodate their customers’ cash needs. The rate typically moves in sync with the target rate set by the Fed.

In addition to providing a benchmark rate for interbank lending, the Federal Reserve uses the federal funds target rate to manage economic growth in the United States. It also influences many other prevalent interest rates, including the London Interbank Offered Rate (LIBOR), which is a benchmark lending rate for many of the world’s largest banks, and the prime rate, which is what banks often charge their best customers.

Also influenced are mortgage rates and interest rates for cash equivalents, such as money market funds and certificates of deposit (CDs).

The question of whether the federal funds rate was an effective economic tool during the recession is still hotly debated. Since December 2008, there has been significant growth in the stock market, in real estate and in other investment assets, while unemployment has hit record lows. At the same time, the recovery has been a prolonged, slow process, with low real-wage growth.

The results of the Fed’s policies on fixed income investors have also been mixed: Many senior citizens typically have an affinity for low-volatility investments like CDs and money market funds. Historically, these instruments have provided reasonable income with little to no price fluctuation, a scenario that’s ideal for retirees no longer wanting to take risks in search of big returns.

However, during the period of the zero federal funds target rate, the yield on cash equivalents was essentially nonexistent, creating a situation where older investors typically lost money after factoring in the effects of inflation.

Since the Fed has reversed course, however, money market rates are now approaching 2 percent, with even higher yields available for CDs. Yields are expected to climb even higher as the Fed continues to boost rates.

The downside? These trends may not be as positive for bond investors. The market value of many bond categories tends to deteriorate as interest rates rise. For example, a 1 percent yield increase of the 10-year Treasury bond results in a 6 percent loss in value after interest payments are factored in. Because investors can buy new bonds with higher yields, existing bonds are less valuable by comparison.

Given the current climate, we are recommending allocations to money market funds and CDs for the first time in many years. A money market fund’s yield is the beneficiary of each quarter-point rate hike without the corresponding risk of price declines. Shortening your portfolio’s duration, which is a measure of a bond’s price sensitivity to interest rates, can help moderate volatility. Floating-rate bonds can be an effective means to that end, as their yields move in conjunction with increases in a given benchmark rate.

At the same time, we are maintaining a balanced strategy that includes allocations to stocks and hedge/alternative investments, in addition to the asset classes previously mentioned. While the yields on traditionally stable investments are rising, they are still low relative to returns sought by long-term investors. Anticipating the Fed’s actions and understanding the reasons behind them can be powerful tools for every investor.