Recently, we’ve been hearing a familiar refrain: The world has changed, and technology companies are again leading the way. How we collectively shop, communicate, work and access entertainment all have been significantly impacted by the COVID-19 pandemic. With such massive shifts in everyday life, the existing paradigm has been disrupted, accelerating trends and creating winners and losers among providers of goods and services to businesses and consumers.

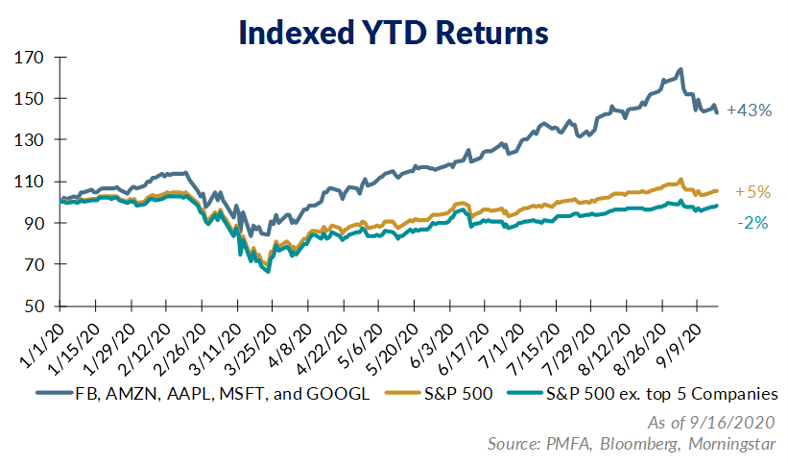

Many tech and communications companies perceived as winners in a post-COVID world have seen stock prices soar, while other parts of the market have swooned. The result? Investors have piled into a handful of names in droves, most notably the so-called FAANGM stocks (Facebook, Apple, Amazon, Netflix, Google and Microsoft).

These businesses seem to have defied expectations by performing comparatively well in the initial sharp decline from mid-February to March 23. Yet, they also fared well in the subsequent, robust rebound. Technology leaders were already well positioned to benefit from the changes brought about by this year’s health crisis, including the shift to remote work, increased e-commerce and the delivery of personalized, in-home entertainment, among others.

Momentum Drives Speculation

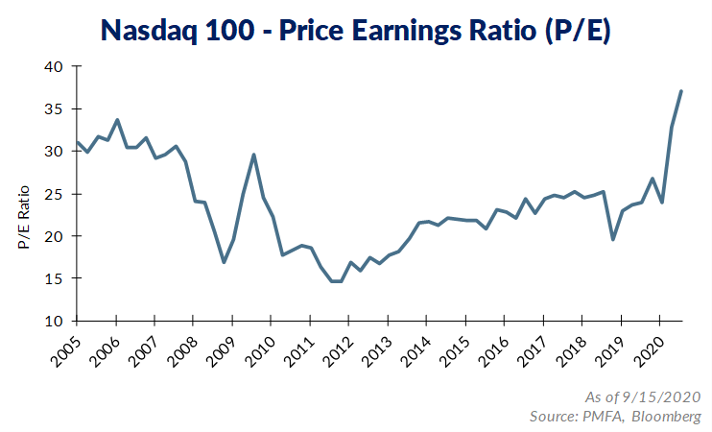

Clearly, these companies are established market leaders with generally strong cash flows, stable balance sheets and quality management teams. It’s an arguably compelling long-term investment thesis, but the strength of recent performance momentum is also driving more investors to speculate by aggressively piling in with less attention to price. The result? Valuations have risen considerably.

It’s reminiscent of the go-go days of the 1990s, when internet stocks were the rage. Investment gave way to outright speculation as Wall Street served up a laundry list of IPOs for many dot-com stocks built on the dual promises of a transformative information economy and earnings that would one day appear.

We know how the Tech Bubble ended, although the underlying thesis was right. The internet was going to change the world, and many companies connected to the coming technology boom were—or would become—global leaders. But that didn’t mean all of those businesses would be successful; it didn’t mean all investors would profit; and it certainly didn’t mean, over the long term, price wouldn’t matter. Even the five largest names in the infotech space at the time would experience sharp drops in their stock price, declines felt by investors for years. Of those names, three (Microsoft, Oracle, IBM) took over a decade to reach their respective bubble-era price peaks; the remaining two (Cisco, Intel)—after 20 years—still haven’t.

Price Matters

In the aftermath of the tech crash, investors shifted focus to parts of the market that had been cast aside. Small-cap stocks came back into favor and outperformed large-caps from 2000 to 2006, while value-oriented sectors also outperformed growth over that same period—not because many of those tech companies were no longer dominant players, but because the prices at the euphoric peak were just too high, well beyond levels even many years of strong future growth could justify.

History doesn’t typically repeat, but it often rhymes. Two decades after the great Tech Bubble, we’re seeing warning signs of the potential for another. Certainly, investor interest in these names reflects the changing nature of the economy and consumer habits. But there’s a real risk that investing based on a stock’s merits gives way to speculating based on that price momentum and chasing returns. In the short run, the influx of additional investors and capital can continue to lift prices, perpetuating momentum. That’s the familiar pattern for asset bubbles, played out frequently in the history of the capital markets.

Risks have certainly risen as FAANGM valuations have continued to rise. Supporting the argument for strong returns are profit margins about double the S&P 500 and strong profit and revenue growth. Despite those tailwinds, the Price/Earnings Ratio on the tech-heavy NASDAQ 100 Index has increased, recently topping 37 times trailing earnings—the highest point since Q1 2004. Ultra-low interest rates have also been supportive, allowing these companies to borrow at exceedingly low rates to fund growth and investment.

Still Susceptible

However, these companies are still susceptible to risk—perhaps the most notable in the near term is regulation. The dominant market presence of these companies and growing awareness of privacy risks are increasingly pressuring policymakers to take regulatory action. Facebook, Amazon, Alphabet and Microsoft have all come under scrutiny in recent years or remain in the sights of Congress. Those concerns don’t break along political party lines, so Big Tech will remain under close watch, regardless of the November election results.

Is there a bubble forming? If so, how far could momentum carry affected stocks? Evidence of froth exists, but there’s no way to be certain. The recent pullback in prices in these names has helped to alleviate some of that froth, but the near-term direction remains unclear and the momentum trade could certainly resume.

There’s a place in a diversified portfolio for companies that are leading innovation and well positioned to profit from both recent and long-term changes to our lifestyles and behaviors. Still, any investment should be sized appropriately—not based on the expectation for an indefinite extension of recent price momentum, but on intrinsic value, growth potential over the long term and ability to provide a rate of return commensurate with underlying risk. They should also fit within the context of one’s greater financial goals, objectives and risk parameters.

The transition from investment to speculation in stocks isn’t always obvious, since momentum carries prices higher and investors seek new ways to justify perpetually rising valuations. This is as true today as it was with former “can’t-miss” investments in darlings of Wall Street—the “nifty-fifty” stocks of the 1970s, the China/commodity stock boom of the mid-2000s or the tech titans of 20 years ago. Investors should be careful not to get caught up in the exuberance and should exercise caution around any “can’t-lose” investment proposition. Even when the investment thesis holds merit, price still matters, and there’s always a limit to the price investors should pay for any stock.

Jim Baird is a CPA, CFP®, CIMA®, CIO and partner with Plante Moran Financial Advisors. Eric Dahlberg is a CFA® and senior equity analyst with Plante Moran Financial Advisors.