Investors are facing a bevy of macroeconomic challenges that collectively contribute to the decline of the traditional 60/40 portfolio. The war in Ukraine, global energy and food crises, rising interest rates to beat back inflation, and the resultant slowing of worldwide growth are all contributing factors.

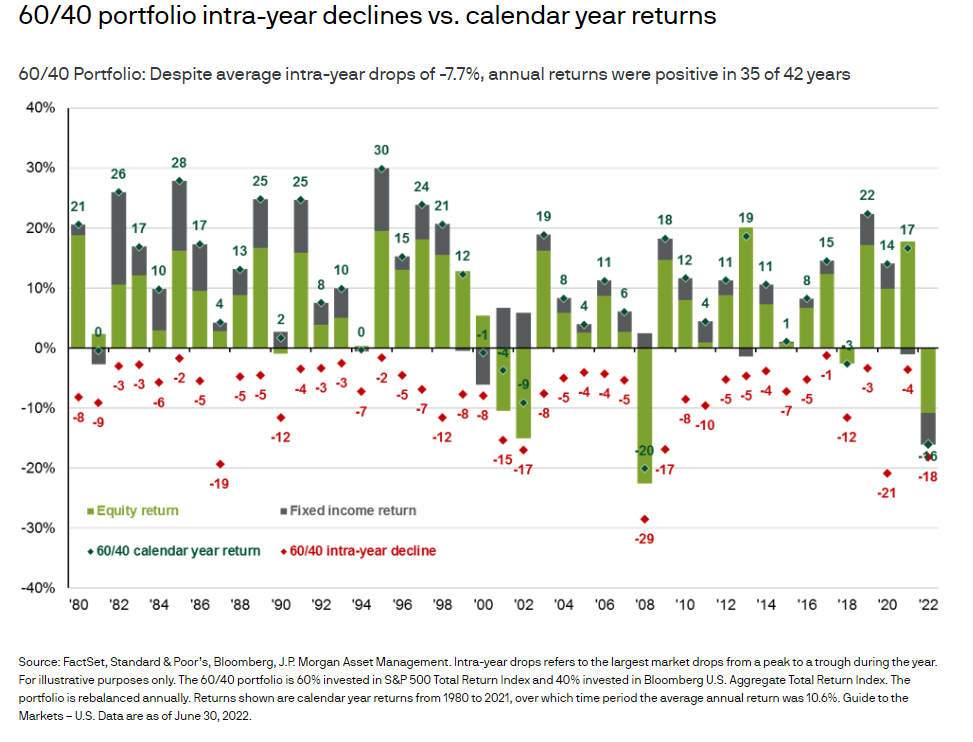

While a portfolio consisting of 60 percent equities and 40 percent bonds has provided positive returns in 35 of the past 42 years and has historically averaged approximately eight and a half percent over the past ten years, this tried-and-true strategy should be questioned. Not only is the 60/40 portfolio down considerably year to date as of late September 2022, but persistent inflation is dramatically cutting into forward returns.

Modern investors deserve a fresh approach. Should they adhere to an investment advisor’s advice who puts them in traditional, diversified portfolios of stocks and bonds, stating ‘just trust the process?’ Why not invest like some of the wealthiest investors in the world? How can you do that? With alternative investments, most notably private equity, venture capital, real estate, personal debt, and private credit.

Alternatives have historically been challenging to gain access to and are more difficult to trade than more traditional investments, so they have largely been restricted to institutions. However, times are changing, according to a study by McKinsey titled ‘U.S. Wealth Management: A growth agenda for the coming decade.’ The study notes that today the average retail investor has just a two percent allocation to alternatives versus 30-50 percent for institutions. McKinsey reports that the retail share could double to five percent in the next three years, adding between $500 billion and $1.3 trillion in new capital to the alternative investment landscape.

Savvy investment advisors are taking notice, placing alternatives in their HNW and UHNW clients’ portfolios to diversify away from the equity and bond markets, boost returns, and generate income. When selecting a financial professional to gain access to the alternative market, here are three critical considerations to keep top of mind.

Alignment of Interest

Strategic investment firms are exploring a broader set of arrangements to improve the alignment of interest between alternative investment products and investor objectives. For example, General Partners (GPs) at private equity firms, hedge funds, and other categories of alternatives, for decades, offered close alignment of interest with investors.

The arrangement aligns the interest of both parties, with performance fees charged only when they rise above a designated threshold. Having ‘skin-in-the-game’ changes the investing dynamic and helps identify relevant prospects while maintaining the proper level of risk/reward for both existing and potential opportunities.

Perhaps most crucially, aligning interests ultimately builds trust between a GP/Manager and the client. Establishing trust is one of the most critical aspects of any financial services relationship and should be considered when engaging with an investment firm to enter the world of alternatives.

- Exclusive or Proprietary Access

Unlike the equity and bond markets, which have been democratized over the past 20-plus years, alternatives require exclusive access to private networks which can provide evergreen deal flow and unique investment opportunities.

Alternatives also tend to be illiquid, making it more challenging to enter and successfully exit these sometimes-complex investments. A GP/Manager and their firm must have decades of experience with various alternatives beyond having access to offer proprietary opportunities not available elsewhere. For example, having operational involvement with a private equity portfolio company can create added value via investment structures, which protects without limiting potential.

- Flexibility to Enter Opportunities

One of the most overlooked considerations when conducting due diligence to enter the world of alternatives is ensuring that the GP/Manager has the flexibility to enter specific opportunities. For instance, large banks or investment managers may be prohibited from investing in the middle market due to smaller deal sizes.

However, a smaller, nimbler manager might be able to move the needle and fill a void by targeting those smaller deals, with a disciplined focus on value-add, lower middle market companies. Returns are typically larger, less competition exists, and strategic buyers can drive outsized returns upon exit from the investment.

- Modern Times Demand Modern Investment Strategies

Contemporary advisors should constantly evaluate new alternative investment options to meet the unique investment objectives of their clients due to the recent faltering of the traditional 60/40 portfolio. To succeed, the GP/Manager must align interests with their clients, have access to exclusive opportunities and maintain flexibility to consider them as an option.

Keeping these three crucial considerations in mind, the advisor can demonstrate the highest commitment to clients. A firm that takes a pragmatic approach to work with a diverse group of private clients and institutional investors will be set up to offer the best ideas and alternative investment opportunities to generate attractive risk-adjusted returns with differentiated value-add strategies.

Francois Schramek, CFA, is a Managing Director and Financial Advisor at Manhattan West, specializing in working with ultra-high-net-worth families spanning several countries across the globe.