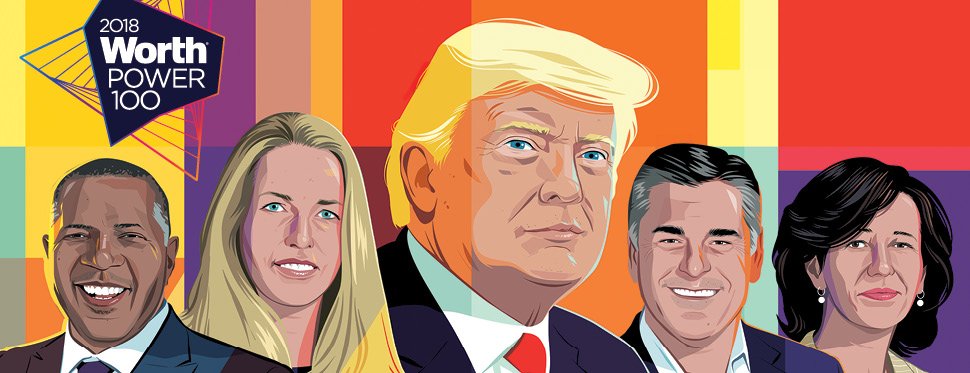

From bankers to businesspeople, pundits to presidents, meet the 100 most powerful men and women in global finance for 2018. Here’s how they’re changing the world.

The Power 100 2018

From bankers to businesspeople, pundits to presidents, meet the 100 most powerful men and women in global finance for 2018. Here's how they're changing the world.

Illustrations by Ben Kirchner