When we think of the finance industry, children don’t often come to mind. Dependent on others, kids, of course, don’t pay the bills or contribute to the finances in a household, and often parents don’t think children should even need to think about money. But maybe children should. Instead of being let loose into the world of personal finance when they turn 18, what if that process was a gradual one built on milestones and lessons learned in a controlled environment? One in which children can take some ownership of their finances and be better prepared for their financial future. To see how this can take action, I talked to two financial app companies who prioritize children in their services, Till and Acorns.

When founder Taylor Burton set out to start Till, a family banking app, he had kids in mind. “I’m from the Midwest, and we don’t talk about drugs, sex or money. Those are all taboo topics, and the end result is a bunch of young people that are underprepared when they enter the economy. So, in partnering with my team at Till, we went out to solve that financial literacy gap,” Burton says.

He realized that kids weren’t given responsibility over their spending and that was hurting them in the long run. He wanted to change that. “It started with looking at what the real issue was and why kids weren’t having success at launch, and I think a really big reason for that is they were never given enough agency early on over the money that was spent on their behalf,” he says. “So, when they entered the economy, they weren’t prepared for the realities of the economy.”

Having financial conversations as early as possible, Burton says, is best. “The longer you wait, the bigger of an issue it feels like,” he says. “It feels like it ups the stakes. So that’s why we say bring Till in as early as possible, so you can start to have those conversations gradually over time, and it can be a more organic experience.”

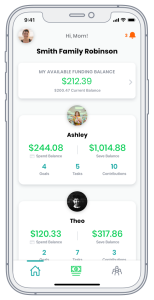

Till focuses on letting kids as young as 8 years old gain some control over their finances. Children, Burton says, are a massive, underserved population in the U.S. “Big macro banks are highly focused on an adult consumer—someone over the age of 18 that they always believed was the most profitable consumer,” he says. “And our thesis was just different than that: We looked at kids as actual, real financial actors and economic actors. A lot of the dependence on your parents or guardian is because you just don’t have access to cash, so that’s what we provide in the form of a digital card.”

“Big macro banks are highly focused on an adult consumer—someone over the age of 18 that they always believed was the most profitable consumer,” he says. “And our thesis was just different than that: We looked at kids as actual, real financial actors and economic actors. A lot of the dependence on your parents or guardian is because you just don’t have access to cash, so that’s what we provide in the form of a digital card.”

Peggy Mangot of PayPal Ventures is an investor for Till and has firsthand experience using the app with her teenage daughter. When Mangot’s daughter created a small business over lockdown, Mangot put her daughter’s revenue into a separate savings account and, like many parents, gave cash to her daughter when needed or lent her a credit card, but found that the method was not working. “Both of those methods—cash and lending her my card—were very undesirable to me,” Mangot says. “She had no visual into how much she had, how much she had earned and how much she was going to set aside for spending.”

When Mangot made the switch to Till these problems were resolved. “[My daughter] can see how much she is spending in real time,” Mangot says. “It just gives her more appreciation for the value of saving and the value of what things cost and what they’re worth to her.”

Mangot mentions that with the increased financial literacy that Till provides, her daughter’s worldview changed. “She has a lot more confidence in money than her friends. We do have a family where we talk about money, but what we were lacking were real-world tools, something in her hands, the app where she could see the debit card. So that has given her a lot more financial confidence,” Mangot says.

Mangot notes that it is important to help your child learn about finance by having them actually participate in it. “If she makes mistakes right now,” Mangot says, “that’s fine, she’s 15. But I would hate to have her wait, be using my cards until she’s 18, and then be making those mistakes when the stakes are a bit higher. It’s all about education, learning by doing and the confidence that she’s getting now.”

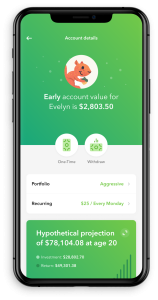

Another fintech company with kids in mind is Acorns, a leading savings and investment app with over 4 million subscribers. I spoke with Acorns’ chief education officer Kennedy Reynolds, about the importance of investing in your children’s financial education when they’re young. The launch of Acorns Early is focused on the financial best interests of “the up-and-coming.” Kennedy states that Acorns “really knows the difference that 18 years makes in a lifetime.”

Another fintech company with kids in mind is Acorns, a leading savings and investment app with over 4 million subscribers. I spoke with Acorns’ chief education officer Kennedy Reynolds, about the importance of investing in your children’s financial education when they’re young. The launch of Acorns Early is focused on the financial best interests of “the up-and-coming.” Kennedy states that Acorns “really knows the difference that 18 years makes in a lifetime.”

According to Kennedy, Acorns Early provides parents and loved ones the opportunity to invest in a child’s financial future from birth.

“You’re talking about tens of thousands of dollars in potential difference,” she continues, “$5 a day invested from birth can be over $60,000 by the time a child is a young grown-up. That’s a pretty big missed opportunity when you think about changing the financial lives of everyday Americans. So, with Acorns Early, you really get the opportunity to begin at birth and give anybody access to an easy investment account you can open in a few minutes and start investing in the children that you love.”

As to why parents should start thinking about their child’s financial future earlier rather than later, Kennedy simply states that “children are expensive.”

“I’m laughing but it really is true,” she says. “Their lives will be expensive. Living is expensive. And the more you can set them up for their future as early as possible, the better. Imagine your child gets a job at 17 but can’t get there because they don’t have transportation. Well, now you’ve got this money sitting in this account that’s just been growing in the background of their life. You’re contributing 10 bucks a week, and there’s that money for the car. The earlier you start investing for this child, the more access you’re giving them potentially without even noticing because that’s how Early is set up—to just operate in the background.”

Education is also very important for Acorns. “I mean access is easier than ever,” Kennedy says. “Tools are everywhere. We’re one of them, and it’s incredibly exciting, the pace at which you can build things and launch things. But as long as it’s coupled with education. That’s very important, particularly for young people, that’s a really important distinction: With access comes responsibility. And for Acorns, our responsibility is not just to provide access, but to provide educated access. I take that piece of it and my job very seriously because if you just give somebody the keys to a car, and you don’t teach them how to drive it, that’s not going to end well. And it’s very similar with your financial life; you can’t just hand over access to day trading or whatever it may be and say, it’s cheap now and it’s really easy to download this app—go after it. You have to accept the responsibility that comes with access and provide the education that allows people to make informed decisions. Every teenager has the right to grow wealth. It’s really our responsibility to provide the education so that teens can do that effectively. If you were to give somebody the roadmap to beginning their financial life, that’s the first step: Educate yourself.”

With children becoming increasingly aware of their surrounding world due to the internet and recent technology, it only makes sense to encourage kids to take control of how they interact with their world, starting with their finances. With Till, Acorns and other companies like them, kids and parents alike can start to think ahead and think smarter, taking the lead in the financial future of younger generations.