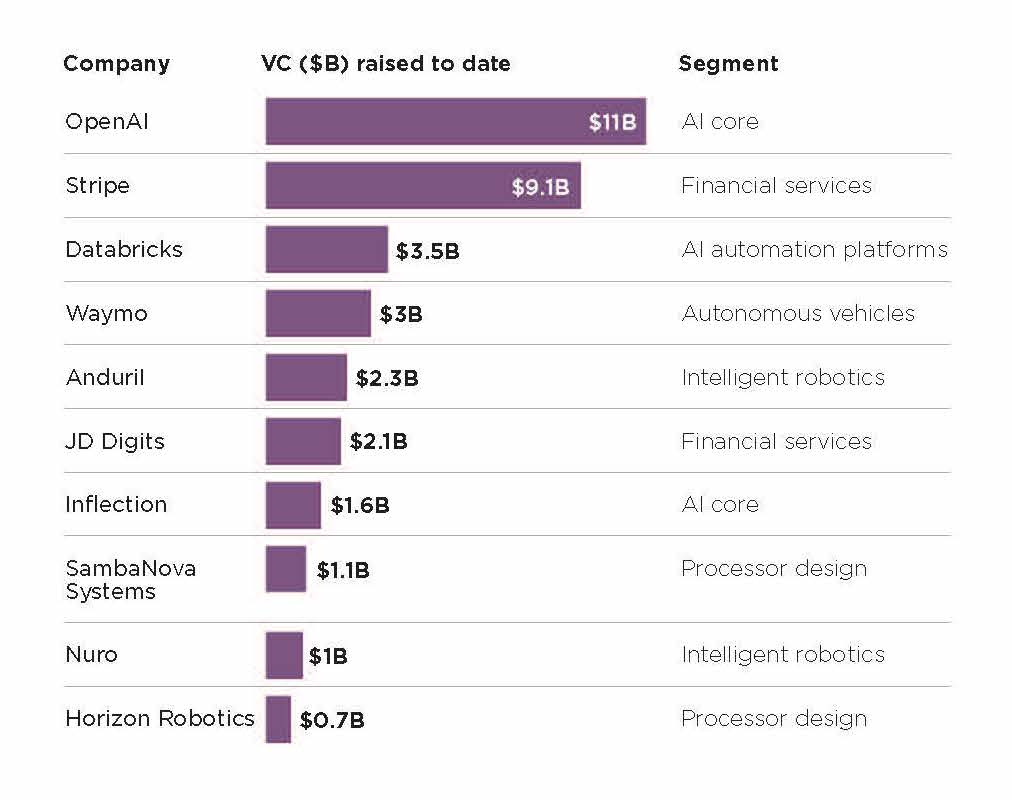

The frenzy over AI was all anyone could talk about at the Collision tech conference in Toronto this summer. Big deals were hitting the news, and stunning announcements were being made at the show. One was by Mustafa Suleyman, cofounder of DeepMind, a revered AI lab acquired by Google. He took to the stage to say that his year-old startup, Inflection AI, had just landed $1.3 billion in funding at a $4 billion valuation—one of the largest rounds of the year.

Join the conversation at Techonomy 23 in Lake Nona, FL on November 12-14.

The excitement was palpable, but stood in stark contrast to what was happening in venture capital overall. Fundraising was at its lowest level in a decade, with exit values as bad as during the great financial crisis of 2008, reported Kyle Stanford, lead venture capital analyst at financial data and research firm PitchBook.

Although AI has been in development for decades, it’s suddenly hot because new tools that can code, create content, and converse like humans have come to market just as a very high need has emerged. Companies that had to lay off sales, marketing, and engineering teams in response to economic uncertainty can still grow with the help of this labor-saving technology, Stanford told me.

Further fueling the craze is a ton of capital raised during the pandemic that went undeployed as market conditions changed and the tech sector slowed down. VCs are deploying that cash to reap returns the fastest way possible—chasing big deals with big checks.

“If you’re the AI company that’s going to unlock a whole new platform, you’re gonna get funded,” said Forerunner managing partner Eurie Kim, to a packed house.

But such sentiment has raised questions about whether all this hype is similar to the irrational exuberance of past tech-investing bubbles or if we’re truly on the cusp of a new era where every aspect of our lives is about to be transformed.

Bulls In the Gold Rush

On stage at Collision, venture capitalists backing some of the buzziest AI startups weighed in.

The market is probably overhyped in the short term and underhyped in the long term.”

Radical Ventures managing partner Jordan Jacobs is an investor in Cohere, which creates generative AI models for enterprise. He feels the startup’s valuation is justified. Reuter’s has its valuation pegged at $2.2 billion, thanks to an impressive roster of backers including Nvidia, Oracle, Salesforce Ventures, Inovia Capital, Index Ventures, Tiger Global, and AI pioneers like “godfather of AI” Geoffrey Hinton and Fei-Fei Li of Stanford University.

“I think Cohere is cheap,” said Jacobs, explaining that the startup has shown strong customer demand, signed contracts, and exponential revenue growth. He says the market is probably overhyped in the short term and underhyped in the long term.

“If you think about it from the perspective of every single piece of software in the world going to have some of this in it, and there’s only a few companies who are going to deliver it—there’s maybe three or four—that opportunity is there for multiple companies to be $100 billion plus,” he said.

Also speaking at the conference was Khosla Ventures partner Kanu Gulati, who was one of the earliest investors of ChatGPT-maker OpenAI. Despite reports of its latest valuation being around $30 billion, Gulati said she doesn’t worry about OpenAI being overvalued. The company has significant financial backing from Microsoft and the tech giant’s help deploying the technology throughout the enterprise. ChatGPT has also become a household name, being integrated into popular apps like SnapChat and Expedia and making an appearance on “South Park,” while becoming one of the fastest-growing apps in Internet history.

“They are leading the entire generative AI space,” said Gulati, explaining these are early days of generative AI transforming every application in the enterprise. “I think it’s here to stay and will make a huge impact on the GDP of countries.”

Elad Gil is a prolific investor who has backed and advised hundreds of tech startups, including Airbnb, Anduril, Instacart, Navan, Notion, Pinterest, Square, and Stripe. He is also an investor in Character.ai, which enables users to create personal chatbots in the likeness of celebrities. Gil believes AI will transform many industries and that people will trust it with mission-critical tasks in time. It usually starts small, he said, but things evolve as capabilities grow.

Gil worries about calls for regulation to stop AI from becoming an existential threat. Quoting Google Brain co-founder Andrew Ng, he said it’s akin to worrying about overpopulation on Mars. “In five or ten years, there will be benefits that will dramatically outweigh the cons,” Gil said.

Bears In The Wilderness

Other investors speaking at the show were more cautionary. Both Slow Ventures managing partner Kevin Colleran and Forerunner’s Kim said they were sitting this one out and haven’t written a new check for any startup in close to 18 months.

Colleran said it’s just gotten too expensive for early-stage firms, like his, which typically writes one-and-a-half million-dollar checks for a 10% stake.

AI companies are raising $100 million dollars at billion-dollar valuations, he explained. Talent is at a premium because there are not a lot of people that can build these technically complex models. Chips and unique data sets are hard to come by and can be pricey, and those first to market have an inherent advantage because these models take time to train and improve with use.

Colleran’s also skittish about the involvement of Microsoft and Google, which are putting most of their internal focus, time, resources, and money toward AI. The tech giants are also some of the largest investors in the space. “The likelihood that a young team of founders is going to beat them is very low,” he said.

Some Bubbling, But No Burst In Sight

Bubble or no bubble, the venture capitalists I checked in with said that, regardless of what happens, they believe the technology is causing tectonic shifts and will shape massive opportunities across all industries.

Costanoa Ventures investor Madison Hawkinson said she thinks we are likely in a bubble. “The market is in the earliest phases of this disruption, leading to a high-risk and high-upside market.” She expects significant churn where many will drop out and there will be a leveling of valuations in time.

Radical Ventures partner Parasvil Patel feels the competition for the best AI companies has caused valuations to spike. But while there might be near term volatility, he expects it to normalize because the fervor is over a technology that actually works and delivers meaningful results. “Current valuations reflect some overexcitement,” he said, “but we are firmly bullish on the long-term prospects for the technology and the impact it can have.”

Insight Partners managing director George Mathew is an investor in Jasper, a generative AI content marketing platform. He said, “We are still underestimating the productivity impact of generative AI across most corporate job functions. Sales & marketing professionals, content writers, and software developers are among the first to see significant productivity gains by leveraging generative AI ‘co-pilots’ for their roles. This will expand for every job function globally over the next decade.”

Lastly, M13 partner Anna Barber said that massive winners will emerge, even if we are in a bubble and it pops. She believes we are at the start of an innovation wave like the dawn of the consumer internet, the advent of mobile technology, and the rise of cloud computing. In this sense, the transformation that is AI is a true paradigm shift.

“There’s a lot of growth to come for AI, and they’ve got time to grow into those valuations,” she said.