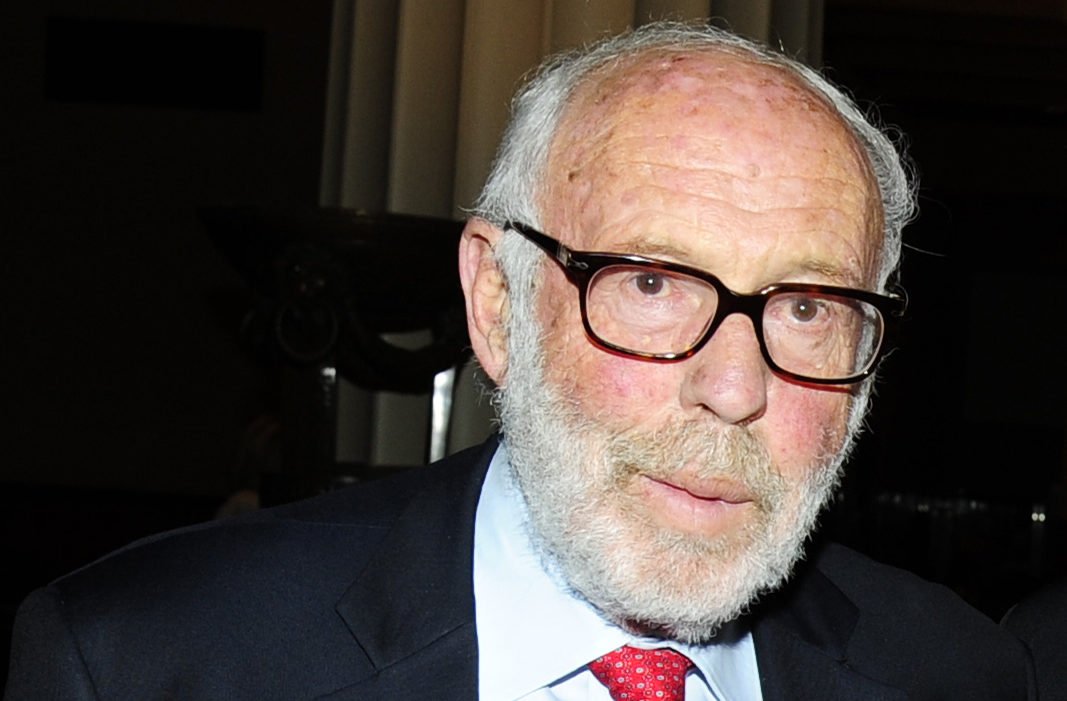

There’s an argument that, perhaps more than any other person, Renaissance Technologies founder James Simons transformed the financial universe. When Mark Zuckerberg was still in diapers, Simons was using algorithms and high-speed computers to beat the market, and the academic mathematician soon became one of the most successful investors in history. Since it was founded in 1988, Renaissance has generated more than $100 billion in trading profits, according to The Man Who Solved the Market, the latest book from Wall Street Journal special writer Gregory Zuckerman.

Yet Simons and Long Island-based Renaissance are also notoriously secretive and only became generally known during the 2016 election cycle when Simons’ business partner, Robert Mercer, emerged as a top backer of alt-right media and Donald Trump’s bid for the presidency. Nevertheless, Zuckerman managed to peek behind the curtain and gain new insight into Simons and the incredible story of Renaissance Technologies. Worth caught up with Zuckerman to discuss the book and why Simons’ story matters.

What surprised you the most in researching and writing this book?

I expected Jim to have discovered a lot of the algorithms and signals. The guy is worth $23 billion and is going to go down as the greatest moneymaker in modern financial history. I figured he was behind some of the breakthroughs.

But there’s more?

I gained a new appreciation for him because he is a quant, and he does the math, and he is one of the preeminent mathematicians of the past 100 years, but he also has this unbelievable other side to him where he has these skills in terms of recruiting and in terms of managing. They’re cutting edge in terms of quant and investment, but also in terms of management.

That’s not what most people would expect of academic mathematicians.

It’s a whole other layer to the story how he got these quirky, stubborn, preeminent mathematicians from all around the world. They’re from academia most of the time, and they’re used to being in their offices and working by themselves. They’re curious people who want challenges, and Simons was able to lure them and get them to work together.

Despite their awesome success and the transformative effect of algorithmic trading on the market, Renaissance Technologies and Jim Simons still seem to run under the radar. Why is that?

Partly it’s the secrecy. They’ve been very focused on secrecy, and he told me he didn’t want me to write the book. He sort of suggested, is it possible to go back and not do this thing? They don’t deal in narratives, and narratives are what investing has always been about. If you turn on CNBC, how would you interview someone without asking them about some narrative about the market or the narrative about a company?

And algorithmic trading inherently ignores narratives.

These guys are cut from a different cloth. They don’t have patience for stories. These guys are the preeminent quantitative investors, and you’d think in their personal money they’d only be quantitative. But they’ll invest in David Einhorn and some of the traditional investors that you and I would. Last year the market is collapsing and Simons is on vacation, and he starts getting panicky about the market. He calls the guy that runs his family office and says, “Should we be buying protection?” It shows me that it’s hard to be a quant.

What kind of legacy does Simons want? Has that been colored by the negative attention on Mercer?

He’s just as concerned about his legacy in the world of mathematics and science. And in philanthropy he’s doing some really fascinating things, and I think he might be remembered as much for that as for investing. He’s an optimistic guy. They’re trying to come up with treatments for autism, and they’re trying to prove the big bang, whether it happened or not. You can get a Nobel Prize for that. I don’t think he’s that concerned. He backed Hillary, so he personally doesn’t feel any responsibility. He’s a complex guy.

How so?

He’s a left-leaning, centrist liberal guy, and you would think the Mercer support for Trump and the hard right would have troubled him. But he was just as focused on the fact that Mercer was making him a lot of money, and Simons likes making money. It’s unusual because he comes from the world of academia, but he likes having influence on society, he likes big, huge ships, and Mercer was making him a lot of money. (Ed. note: Mercer left Renaissance Technologies in 2017 and sold his stake in Breitbart News to his daughter Rebekah.) If he didn’t love money so much, I think he’d feel a little more responsibility.

So on the one hand, he can be a cutthroat investor, but on the other, he does seem to want to have a broader impact on society.

You can argue that one person shouldn’t have so much wealth or so much impact on our society. But he’s not pursuing vanity projects. There’s something to be said for pursuing wealth. Increasingly we denigrate the pursuit of wealth in society, but he’s a reminder that one can pursue wealth with an eye on impacting society in good ways.

The Man Who Solved the Market—How Jim Simons Launched the Quant Revolution, Portfolio Penguin, 356 pages, $30