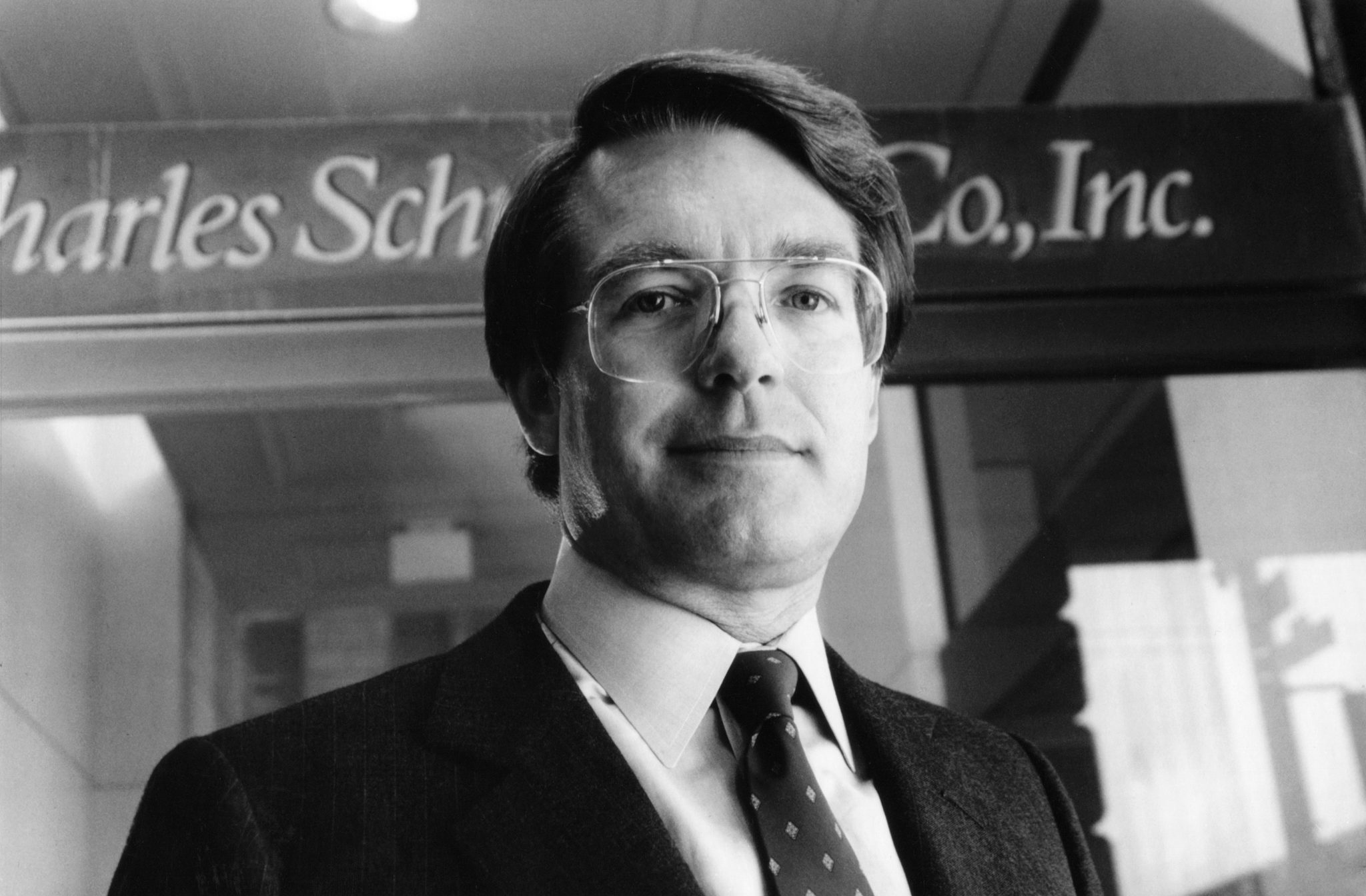

By his own admission, Charles Schwab had been a mediocre student who struggled with dyslexia before starting his eponymous investment firm  in San Francisco in the early 1970s. But the Charles Schwab Corp. was different from other financial services companies with its focus on independent investors, and Schwab himself—as his new autobiography, Invested: Changing the Way Americans Invest, shows—wasn’t your typical entrepreneur. Today, Schwab has more than $3 trillion in client assets. Following is an excerpt from Invested, scheduled for release on October 8 from Currency, on the company’s IPO—just before the market crash of 1987.

in San Francisco in the early 1970s. But the Charles Schwab Corp. was different from other financial services companies with its focus on independent investors, and Schwab himself—as his new autobiography, Invested: Changing the Way Americans Invest, shows—wasn’t your typical entrepreneur. Today, Schwab has more than $3 trillion in client assets. Following is an excerpt from Invested, scheduled for release on October 8 from Currency, on the company’s IPO—just before the market crash of 1987.

Compared to the first go-round, this IPO was more conventional. For one thing we never had any illusions about underwriting it ourselves. Instead, we engaged Morgan Stanley and First Boston, two prominent Wall Street firms whose willingness to participate I viewed as yet another sign of how far we had progressed as a company and an industry during the 1980s. That said, I introduced a couple of elements that added to the complexity of the deal and ultimately forced us to delay the offering until September of ’87.

One, I set aside a big chunk of stock for our own customers—50 percent of the shares. The investment bankers fought me, I expect because it left them with fewer shares for their customers. This is unheard of, they said. And it probably was. But I was sure this was going to be a successful IPO and I was determined to give Schwab account holders a piece of the action. And as committed investors, they were also committed to Schwab.

Two, we went into this IPO knowing that many of our employees were holding warrants I’d apportioned during the buyback from Bank of America. Those warrants were designed to make my people whole after the BofA debacle when the shares they received then shriveled up. We had received $22 per share in BofA stock at the close of the deal in 1982, and by 1985 the value was down to $18, heading to $9 by 1987. My employees had seen a lot of their personal wealth evaporate. As part of the buyback, we gave warrants to purchase future shares in Schwab to employees. They were given out proportionally to the losses they had incurred in BofA stock. To me, it was a matter of integrity. I had led them into the acquisition and I wanted to be sure they had the chance to make up for the financial losses of that decision. So I wanted them calculated into the mix for this IPO. As it happened, the warrants did much more than make people whole. They would form the foundation of large personal fortunes for many longtime Schwab employees.

In August I left the country for a long overdue vacation, a three-week photo safari in Africa with my family. It was not the most relaxing vacation I have ever had. Now that the decision to go for the IPO had been made, the risks of something getting in the way loomed in my mind. Those ominous rumblings in the market had gotten worse.

I was calling San Francisco and New York every chance I got. Let’s go, let’s go, I encouraged. After a sharp run-up in July, the market had leveled off in August. We know now that August 25, when the Dow closed at 2,722, was the peak of the bull market. No one knew that at the time, of course. Most saw it merely as the pause that precedes the next advance. Still, I worried. The sense of urgency I had felt in the spring was greater now. We kicked into high gear.

We did the road show in early September. Larry, Rich, and I spent a week making presentations to institutional investors in major cities all over the country, followed by a flight to Paris on the Concorde and quick visits to London and Frankfurt. Heady stuff, and I enjoyed it, even on those days when I found myself making the same pitch three times a day to different groups in different cities. One of the most memorable stops we made was in Boston, where we met with Fidelity. The room was packed with more than two dozen analysts. Fidelity carried a lot of weight on Wall Street—it was critical to the success of our offering. But Fidelity was also a direct competitor, and therefore intensely curious about our operations. They grilled us for two hours. We had answers for everything they threw at us. We got nothing but good reactions. We were ready!

On September 22, 1987, 15 years since I bought out my partners in First Commander and launched my fledgling company on a wing and a prayer, and just six months since buying Schwab back from Bank of America, trading in the Charles Schwab Corp. commenced on the New York Stock Exchange under the symbol SCH.

We went off at $16.50 per share, well above the $12 to $14 range we had anticipated when we first contemplated going public. The total value of the 8 million-share offering was $132 million (we closed at $16.625). Within 24 hours we wired $87 million to Security Pacific Bank, not the whole nut but enough to lessen our debt burden and still leave us with a comfortable cash cushion and ensure smooth operations even in a choppy market. A huge chunk of my discomfort with our debt had disappeared. At the same time, my net worth took another huge leap forward. My personal stake in Schwab was now worth $100 million. I was by any measure a rich man, wealthier than I had ever imagined. It was less than 100 miles away, but Woodland, Calif., and all my parents’ worries about money seemed a universe away.