One of the most fascinating aspects about being a financial advisor is helping clients see what is possible when their finances are in alignment with their hopes and aspirations. Recently, we met a client who spoke a lot about his desire to get into investment real estate. However, when we looked at what he was doing with his money, it was in total contradiction with the stated goal of building an investment property portfolio. Some was being invested into his 401(k), some in various investment accounts and some was being used to pay down his low interest rate mortgage. In short, there was little left to buy a property; his money was sprinkled across too many accounts and too many institutions.

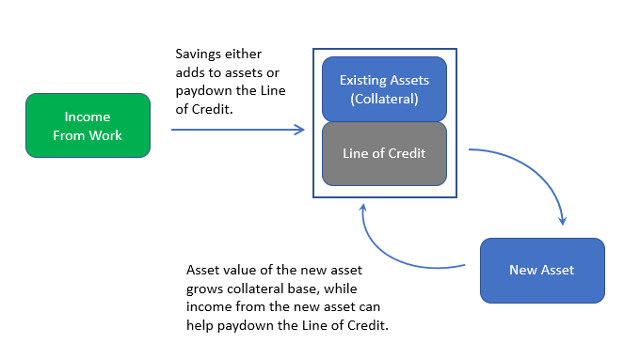

This led us to a discussion of two planning strategies—both work, but one can be a bit more powerful. The first is what we call destination planning. Here, there is a goal (college, house, boat, etc.), and then there is an account to meet that goal. With college, that might be a 529 account, whereas down payment money is typically saved to a bank or money market account. The second is what we call “capital recycling.” This is when a long-term strategy is put into place, collateralized lines of credit are used to meet the opportunities and obligations along the way and cash flow is used to pay down the lines of credit, so the money is available in the future. We call it capital recycling because we are using an existing asset’s value to purchase a new asset and using cash flow from regular income and assets to pay down the debt.

Destination Planning

Most people are destination planners. It is very organized. There is the 401(k) for retirement, the 529 accounts for the kids’ college and savings accounts for the bar mitzvah or sweet 16.

I will be the first to say there is nothing wrong with this approach, but there are some drawbacks. The primary drawback of this strategy is that you are purposefully disrupting your compound curve, or you are taking a risk that the time you need the money may not be the best time to sell the asset. A great example of this is the 529 plan, where the account shifts more towards fixed income as college approaches and, as a result, those dollars will have a lower expected return (disrupting the compound curve). The alternative within the 529 is keeping a high equity allocation until college starts, but then you run the risk of a market correction or crash exactly when you need it.

Capital Recycling

A different approach, employed by some of the wealthiest individuals in the world, is to use collateralized debt as a tool to pay for big ticket items, avoid taxable events and improve your bargaining position for certain transactions. I specifically say collateralized debt for two reasons. The first is, when you have collateralized something, you have the wherewithal to spend the money. You are just choosing not to sell an asset to do it. The second is, by collateralizing or securing the loan, you can obtain substantially better interest rates (sometimes as low as 2 to 3 percent) versus an unsecured loan (i.e., credit cards). This article is not advocating the creation of high interest rate debt to achieve your goals.

When this approach is employed, a long-term strategy can be set in motion and funded without concern for short and intermediate term goals. The focus becomes building the capital required to live the life you want, not filling specific buckets. Whether the lines of credit are being used or not, the assets are invested. This differs from someone who keeps money in cash for a down payment five years out or someone who invests in private equity maintaining large balances in cash in case there is a capital call.

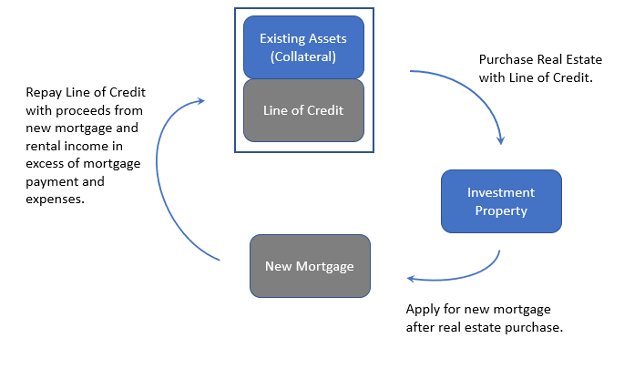

Being a Cash Buyer, With Other People’s Money

One of the unique aspects of being a capital recycler is that you can become a “cash buyer” in private transactions. This brings us back to our new client, the aspiring real estate investor. When we shared our thoughts about his situation, we suggested a possibility. What if instead of dividing his money between five institutions, he consolidated under two or three. Once he does that, he will have enough in his account to get a line of credit. If, or when, he finds that investment property, he could use that line of credit to show up as a “cash buyer,” which puts him in a stronger negotiating position. Once he owns the property, he can then go out and get a mortgage on it and use the proceeds, future savings and the rental income to pay down the line of credit. Once the line is paid down, he could do it all over again, building his real estate portfolio. Now that is capital recycling!

A Word of Caution

Debt is neither good nor bad. It is how it is used that determines whether it is good or bad. Capital recycling should only be used when working with competent advisors (financial, tax and legal). This is especially true in choosing the types of assets that are most appropriate to be used as collateral and the amount of leverage to use.

Vidal Peoples is a veteran financial advisor for Strategies for Wealth who works closely with individuals to guide them towards improving their financial lives and building financial confidence. He specializes in working with medical, legal and other professionals to build their wealth and protect their assets.

Marc Gensler, CFA, is a personal financial strategist for Strategies for Wealth. It is his mission to show his clients that their financial concerns can be solved through thoughtful and efficient design that gives them permission to take actions they previously thought impossible.

This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC and your financial representative are not undertaking to provide investment advice or make a recommendation for a specific individual or situation, or to otherwise act in a fiduciary capacity. Registered Representative and Financial Advisor of Park Avenue Securities LLC (PAS). Securities products and advisory services offered through PAS, member FINRA, SIPC. Financial Representative of The Guardian Life Insurance Company of America® (Guardian), New York, NY. PAS is a wholly owned subsidiary of Guardian. Strategies for Wealth is not an affiliate or subsidiary of PAS or Guardian. CA insurance license #0K86573. 2021-125499 Exp 08/23