From the explosive growth of telehealth to a renewed sense of the importance of epidemiology, COVID-19 has upended nearly every nook and cranny within the sprawling American health care juggernaut. But nowhere are the tectonic plate shifts ripping across the health sector more evident than in senior care, as crowded nursing homes and assisted living facilities have essentially become ground zero for the deadly virus.

A recent New York Times article summed up the catastrophe: “Of all the missteps by governments during the coronavirus pandemic, few have had such an immediate and devastating impact as the failure to protect nursing homes. Tens of thousands of older people died—casualties not only of the virus, but of more than a decade of ignored warnings that nursing homes were vulnerable.” According to the World Health Organization (WHO), roughly half of all coronavirus fatalities in Europe have been traced to nursing homes. In the U.S., where COVID-19 has spiraled out of control, more than 40 percent of all coronavirus deaths are linked to long-term care facilities.

Take, for example, Seattle—the initial epicenter of the pandemic in the United States. Despite accruing nearly 40 initial COVID-related deaths at a local nursing home facility, state and federal health officials failed to recognize and act to contain the virus in a timely manner, making the Seattle area the first major hot zone in the country.

But senior care, of course, is much more than just nursing homes; it’s a vast and layered mélange of services, products, payors and providers that come together to address the nation’s nearly 50 million citizens over the age of 65; one might think of it as a continuum of age-adjusted needs.

On one end of the spectrum are the millions of seniors that are in excellent physical health and exhibit little if any cognitive decline. These individuals are seniors in age only and are the kind that one typically sees celebrated in TV commercials, enjoying retirement, taking young grandkids to the park and pitching reverse mortgages. This cohort lives independently, enjoys access to quality health care and has a family or quality social network to lean on.

On the opposite end of this range are those seniors struggling with chronic conditions, severe cognitive disorders, and who are very much dependent on caretakers for daily living—which often means that their needs can only be met by living in long-term care facilities. The worst off in this cohort are also impacted by a variety of unfavorable social determinants of health, such as poverty and social isolation. In between those two extremes are myriad combinations of physical and cognitive health situations swaddled by a colorful tapestry of sundry socio-economic factors and social determinants of health.

Even though the novel coronavirus has most acutely affected long-term care facilities, the pandemic’s devastating impact on these institutions has cast a not so flattering light on the entire sector, exposing an underfunded, technologically underserved, inefficient and oftentimes siloed care network. Stephen Pacicco, president and CEO of MatrixCare, the country’s largest post-acute care technology provider that focuses on the entire spectrum of the senior industry, sums up the impact COVID-19 has had in exposing the deficiencies that span the entire U.S. health care system: “Fixing healthcare—particularly for seniors—is a societal imperative. We all owe it to our parents and grandparents to be able to ‘age in place and age with grace.’”

Frail and aged residents at nursing homes are obviously especially susceptible to a lethal virus, but a panoply of pervasive structural weaknesses that span across the entire U.S. senior care model—namely underinvestment as well as oftentimes poorly trained and underpaid personnel—have exposed its extreme vulnerabilities. Put another way, if the aging sector was a brush fire before COVID, many experts in the geriatric space feel that the pandemic—and the federal government’s pusillanimous response to contain it—did nothing but fan its flames.

To better understand this phenomenon stateside, Worth turned its sights to Minnesota—one of the few states that has largely managed to fend off the surge of cases that is still burning its way through states in the Sun Belt yet where long-term care facilities continue to account for nearly 80 percent of COVID deaths. Minnesota presents an intriguing case study because not only has its elderly population been particularly hard-hit compared to the general population, but its major population hub, the Twin Cities of Minneapolis and St. Paul, has long been heralded as the nerve center of the U.S. health care industry; the North Star State is home to medtech and health care titans such as Medtronic, UnitedHealth Group and Mayo Clinic, as well as a vibrant health-tech startup community.

“Minnesota is this really interesting case in that, the early efforts to curb the virus have been—at least relative to most of the rest of the country—somewhat successful,” commented Dr. Sameer Badlani, the chief information officer of the M Health Fairview, one of the state’s largest hospital systems. “That this phenomenon affecting long-term health facilities occurred here of all places, which happens to be a thriving center for healthtech, has given many of us in the health care and technology fields a front row seat to witness up close the impact of these unprecedented set of circumstances—as well as an opportunity to address them; it’s only natural that much of the innovation in senior care coming out of the pandemic is being largely driven by Minnesota-based companies.”

Our senior population has been hit hard by #Covid_19 but it has mobilized MN’s entire @MedicalAlley healthcare ecosystem. Amazing transformations in #seniorcare from #digitalhealth startups to #healthcare heavyweights are happening now.

— Dale Cook (@LearntoLiveCEO) August 13, 2020

“There is more innovation happening around senior care and the aging business writ large in Minnesota than just about anywhere in the United States,” commented Shaye Mandle, president and CEO of The Medical Alley Association, a Minnesota-based trade association that represents hundreds of companies that operate across nearly all facets of the health sector, including major players like Boston Scientific, 3M, Ecolab, The Mayo Clinic, UnitedHealthcare and healthcare newcomer Best Buy, as well as a bevy of promising digital health startups such as Bright Health, Bind, Learn to Live and Zipnosis. “Advances in data science, artificial intelligence and technology will make senior care appear much different five years from now than it does today. And these same advances will render today’s prevailing models almost unrecognizable by the end of the decade.”

“The revolution in senior care—one that will be largely powered behind the scenes by technology—is happening now, and many of the companies involved are based right here in Medical Alley,” added Mandle, referring to the famed technology and health corridor that stretches from the Twin Cities down to Rochester, Minnesota, where the world-famous Mayo Clinic is headquartered.

Lifesprk: Pioneering a New Model of Data-Driven Senior Care

One of the Medical Alley members that certainly hopes to be part of the massive transformation in senior care is Lifesprk, a company that many analysts believe is literally building the model that will drive the next decade of innovation and advancement across a large swath of the aging sector.

Key to the Lifesprk approach to senior care is combatting the rising costs of health care by addressing the social determinants of health—the panoply of vectors not typically captured in a traditional medical file, such as income levels, living conditions, social interaction, family ties and food access, among many different soft factors that oftentimes play an equal or even greater role in outlining a given individual’s health profile. By leveraging big data and sophisticated proprietary algorithms, Lifesprk’s approach is predicated on the powerful idea of “whole-person” care for seniors.

Lifesprk is developing what company CEO and cofounder Joel Theisen has branded as an Electronic Life Record, or ‘ELR’—a data set that captures not only all the inputs that a typical medical profile would contain but also hundreds, if not thousands, of additional data points that can be highly predictive as far as optimizing bespoke care solutions for an aging population. Lifesprk’s ELR captures and processes thousands of terabytes of data on a massive, anonymized scale and then cross-references that data with known inputs on an individual level. The end-result is translated into highly personalized predictive care models which are then prescribed for in-home care.

If that sounds remarkable, it’s because it is.

It is precisely this novel approach to upending traditional senior care models that attracted Los Angeles-based venture capital firm Virgo to plow $16 million into Lifesprk earlier this year to speed up the deployment of this new set of business processes across the country. “By 2030, the senior population in the U.S. will approach 72 million, and it’s a sector in desperate need of a new operating paradigm,” commented Pooja Goel, Virgo’s managing director who led the Lifesprk investment round. “Lifesprk is what we like to call a transformative company that is literally reshaping an entire sector. Joel and his team utilize a value-based population health solution that delivers what we like to call the ‘triple aim’ of improved client experience, improved health outcomes and overall lower total cost of care.”

The Lifesprk data-driven approach to transforming senior care is not some idea spun up by a recent MBA grad identifying whitespace in a multibillion-dollar market. In fact, Lifesprk has been in business since 2004, and it was only through hundreds of thousands of hours of thorough hands-on management of thousands of seniors over the past 15 years did it arrive at the breakthrough concept of leveraging big data and predictive artificial intelligence to deliver whole-person care for the aging.

Lifesprk is a preview of what senior care will look like in years to come.”

“Senior care is not the sexiest sector in health care which probably, unfortunately, explains why it hasn’t seen as much innovation as one might expect,” remarked Fox Business Channel analyst Ethan Bearman, who closely follows the impacts of how technology is transforming health care. “But Virgo’s recent investment in Lifesprk shows that all this is changing—and quickly. The Lifesprk model is a window into what the $200 billion in-home senior care market will look like a few years from now. Who would have guessed just a couple of years ago that grandma and grandpa would be able to stay at home longer and live healthier, more fulfilling lives—all thanks to complex data sets running in the background, using algorithms to crunch the numbers that leverage predictive AI to recommend the best care solution. Lifesprk is a preview of what senior care will look like in years to come.”

A Gold Rush in Search of Silver

The massive sector growth Bearman was referring to—some pundits have taken to calling this looming crisis in aging, spurred by millions of Baby Boomers moving into the senior ranks, as a “Silver Tsunami”—suggests that the senior home care market is expected to expand to over $225 billion by 2024, driven not only by an expanding elderly population but by runaway health care costs as well. Add that to a rapidly expanding long-term care market currently valued at nearly $450 billion, and the size of the entire senior care space is suddenly just a stone’s throw away from being a trillion-dollar market within the next few years.

A behemothic market size, ample disaggregation and widespread inefficiencies are some of the main drivers that led famed New York City-based private equity and venture capital investor Alan Patricof to take notice. The founder of Apax Partners and Greycroft recently announced that he hooked up with Abby Miller Levy, the former president of Thrive Global, the global wellness company founded by Arianna Huffington, to invest in early-stage companies looking to ride the waves coming ashore amid the forthcoming Silver Tsunami. Together, they founded Primetime Partners, a $32 million venture capital fund that will back companies offering an array of products and services targeting an aging population.

The size of the entire senior care space is suddenly just a stone’s throw away from being a trillion-dollar market within the next few years.”

The opportunities Primetime are looking to address are not unique to the U.S. market. Across the globe in many developed countries, a general ‘greying’ of the national population is a major societal challenge. Time Magazine has gone so far as to call China’s aging population a “major threat to its future,” while countries like Italy, France and Spain are already in the throes of a disproportionately senior-heavy population. For Andrea Fiorani, group head of Personal Lines at Paris-based Europ Assistance Group, a global player in senior care services across the globe, many developed countries are staring down the barrel of a panoply of health-related social and political issues related to aging populations.

“A looming issue for the senior care industry around the globe is the upcoming Silver Wave,” observes Fiorani. “The current setup is not fit to sustain populations aging rapidly as birth rates decline. The recent pandemic has also shown the limits of facility-based care. More options will need to be found, and home- and tech-based solutions, often combined, will help fill some of the current gaps, but solutions designed to reduce the strain on senior care facilities and promote independence, like telemedicine and tech enabled home-care services, will be a major part of the elder care model of the near future.”

A US Senior Care System in Crisis

Stateside, just about anywhere one looks, there is no avoiding the wave of septa-, octa- and nonagenarians that will come crashing down on the shores of the U.S. health system; by 2030, the U.S. will have more than 70 million seniors, up from roughly 50 million today. But the strain this population influx will put on an already fragile and antiquated senior health system is creating massive opportunities for disruption and creating new markets.

“We believe organizations that earn the trusted relationships with seniors and their families will dominate these newly minted verticals,” observed Lifesprk’s Theisen. “The timing of this ‘tsunami,’ together with a panoply of factors such as unsustainable run-away costs and payment reform along with heightened societal pressures, will force the system to move from high-volume to value-based care. With major technology and analytics advancements already underfoot, we expect to see all of this come together to create the perfect ecosystem for major disruption and re-design across the entire senior care space.”

The number of Americans aged 65 and older has grown by a third in the past decade—faster than any other age group according to U.S. Census Bureau data. And although Americans older than 50 have 70 percent of the buying power in the U.S. according to a 2017 book entitled The Longevity Economy: Unlocking the World’s Fastest-Growing, Most Misunderstood Market by Joseph Coughlin who runs the MIT AgeLab, the cohort’s wealth is far from evenly distributed, further punctuating the need for government programs to step up and bridge what seems to be a chasm growing wider and wider by the day.

“Far too many seniors are not living out their ‘golden years’ as they should—and Lifesprk wants to create the infrastructure to make many more seniors live healthy, purposeful lives,” mused Theisen. “It’s about aging in place with dignity.”

Kurt Waltenbaugh, CEO of Minneapolis-based health care analytics company Carrot Health, agrees that the wave of healthier, longer-living boomers will push the incumbent U.S. health care infrastructure to the limits, but he also cautions that the country will likely see a period of near-term challenges affecting seniors and those now nearing retirement directly linked to the long-tail of COVID-19. “The U.S. will see a decade of indirectly reduced life expectancy among seniors,” said Waltenbaugh whose company crunches consumer behavior data to anticipate future impacts and trends. “Economic and physical health are closely linked, and those who are seeing a decrease in wealth linked to the economic crisis stemming from the pandemic are spending less, reducing savings and cutting back on both elective and needed preventative medical care to make ends meet.”

Without the FCC minimum broadband speed and a digital device, some seniors might as well be back in 1995 with in-person care as the only option.”

“Seniors are putting off doctor visits, cutting back on medications and experiencing increased stress and depressive symptoms,” added Waltenbaugh. “The entire senior care sector is going through something of an innovation renaissance with a host of new technologies and platforms coming to the market, but we can’t forget that countering all these new tools will be a large swath of the senior pool that is facing socioeconomic straits far worse than prior to the onset of the coronavirus and the ensuing economic impacts.”

The Future of Senior Care Is in the Home

In the process of conducting research for this article, Worth canvassed nearly 60 leading health care, technology and policy experts representing over 40 different companies, organizations and public-sector entities with wide ranging views on what is happening across the senior vertical within health care; despite the wide range of experts interviewed, across the board, one common theme that resonated in nearly every single conversation was the growing importance of the home in the future of senior care. “There is no doubt about it: The home is the new hub of senior care,” said MatrixCare’s Pacicco. “As business models move from the all-too-common fee-for-service model towards for-profit Medicare Advantage plans, there will naturally be economic incentives on the part of private health plans to keep the seniors under their care in their own homes longer and living better and full lives. And the way you do that effectively, at scale and with lower costs, is through technology.”

Amazingly, seniors respond really well to online therapy.”

Pacicco foresees a future in which most clinical care happens outside of the high-cost (and, since the pandemic, increasingly dangerous) environs of hospitals and traditional primary care clinics. For him, the key is not only more preventative care, but also an increase in real-time, in-home monitoring, a focus on well-being and more attention to the social determinants of health. “One element of this is risk stratification,” added Pacicco. “Not every 70-year-old is the same. Some are out running marathons, while others need a tremendous amount of support. It’s all about assessing one’s ‘risk-adjusted age.’ That’s where AI comes into play to determine what sort of attention and preventative care an individual may need to stay healthy—and what environment would best suit those needs. The ‘one-solution-fits-all” mentality has created this giant bottleneck in the system, but technology is making it easier for insurers to take on more risk by adopting a value-based approach to care, which lowers cost and improves care.”

As an example, a recent study published by Premier, a health care improvement company that works with 4,000 U.S. hospitals and health systems, determined that over 60 percent of costly emergency room visits are avoidable. The study cited that roughly 30 percent of ER visits by those with common chronic conditions are likely completely unnecessary—which amounts to over $8 billion in additional costs for the industry. “Early detection and intervention of potential issues will go a long way towards reducing senior ER visits, hospital stays and even routine doctor visits, but it will all depend on having the right technology infrastructure to make that happen—and that’s the real change we are seeing happen across the entire senior care industry,” added Pacicco.

“There is no way we can build enough quality assisted living and long-term care facilities—much less fund and staff them—to meet the demands of a silvering Boomer population,” noted Barb Stinnett, CEO of the Timmaron Group, a Silicon Valley-based health care and high tech consultancy. “The key to managing a growing elderly population worldwide is ubiquitous, omnipresent and intelligent monitoring technology that doesn’t interfere with daily living and certainly asks nothing of the seniors themselves. It is tech that is always on and able to detect the slightest variation in habits and behavior. It can prevent serious injuries before they happen and knows when to escalate to human intervention.”

“The smart money in Silicon Valley is betting on smart homes for seniors,” added Stinnett, who believes that even the configuration and design of homes will be dramatically impacted to accommodate the waves of seniors that will be staying at home longer. She believes that the standard home that targets seniors will have a built-in ‘health care room’—an area where an array of health care monitoring equipment is located that will enable seniors to sit down and plug in an array of devices. “You will literally ‘plug yourself in’ and connect with a sophisticated AI that will takes your vitals,” says Stinnett. “Although this all sounds somewhat futuristic, the technology is here now. It just hasn’t scaled yet—but it will.”

Universal Access

Of course, when it comes to addressing this Silver Tsunami, the multi-billion-dollar elephant looming in the room is what role the government will play in enabling these new technologies to take hold in the sector—and to what degree federal and state funding will be available to that end. Some industry insiders are optimistic. “The government is starting to get it—you see that with expanded Medicare Advantage plans and more benefits around telehealth services,” commented Kerin Zuger, chief of strategic growth at Omaha, Nebraska-based Right At Home, a leader in the in-home senior care industry.

But widespread adoption of telehealth presumes widespread highspeed connectivity, and access remains a big issue that stands in the way of fully folding in disadvantaged seniors into a future that plans on leaning in on virtual medicine. According to Harvard Business School Professor Dr. Regina Herzlinger who authored the influential health care page-turner Who Killed Healthcare?, half of seniors living alone and nearly a quarter of those in two-person homes struggle to afford basic necessities. For this at-risk group, access to digital devices and broadband is not even in the realm of possibility without some sort of government funded assistance.

The smart money in Silicon Valley is betting on smart homes for seniors.”

Sara Ratner is a veteran health care leader and expert on government programs at Minneapolis-based Revel Health, a company that helps the health care industry more effectively communicate with people to effectuate changes in behavior. She believes that one of the key issues facing CMS, the Centers for Medicare and Medicaid Services, and their ability to fully leverage all the innovation happening in the private sector, will be the deployment of both hardware and connectivity to bring all seniors online. “All this innovation around telehealth and virtual care for seniors assumes that there is sufficient broadband connection and access to some sort of device. Without the FCC minimum broadband speed and a digital device, some seniors might as well be back in 1995 with in-person care as the only option,” stated Ratner. “Some health systems are actually deploying Google Chromebooks, as well as heavily subsidized broadband, because they know that in the end, a virtual care model will deliver better care and save money.”

Ratner’s comments allude to a stark trichotomy in the U.S. health care system that segments seniors into three discrete categories: those who have Medicare Advantage or supplemental insurance and are relatively healthy, those who have chronic conditions and are in need of intensive care and treatment, and finally, the dual eligible seniors who are facing a myriad of health and financial issues. “Much of the attention and innovation in senior care is happening in and around providing access to new discrete supplemental benefits, such as gym memberships and transportation, as well as food access and delivery,” added Ratner. “The real challenge will be continuing to find new ways to improve the health and lives of those with very complex and chronic conditions, and who require augmentation of and support around social structures to help manage their health care.”

Ratner’s sentiments were echoed by Dr. Lissy Hu, CEO and founder of CarePort Health, a Boston-based technology platform used by thousands of providers across the country to better coordinate and manage care across the health care continuum. “As Medicare Advantage grows, we’re going to see more of the private sector taking on senior care and working to determine how to manage the elderly patient population,” offered Hu. “As patients turn 65 years old, many will opt for Medicare Advantage instead of fee-for-service Medicare. This impacts the elder care model because senior care will be more closely managed under Medicare Advantage.”

“With health plans responsible for patient care across the care continuum, they will focus more acutely on a patient’s journey over time. As a result, we will see less siloed care with more services and technologies connecting doctor’s offices, hospitals, post-acute care and rehabilitation facilities, and at-home care—all of which have historically been disparate care settings,” added Hu.

The home is the new hub of senior care.”

Jeannine Rivet, who recently retired as an executive vice president of UnitedHealth Group, the largest health care and health insurance company in North America, sees technology as playing a major role in revolutionizing many aspects of the geriatric market, but cautions that it won’t impact all areas of senior care equally. Rivet believes that its impact will be much greater in downstream services that support seniors aging at home, or those in assisted living that still have some modest degree of independence. “I don’t know that we are at a point where we can say that AI and new tech will significantly impact long-term care, where the delivery vector is still very reliant on human caregivers and nurse practitioners,” observed Rivet. “But for seniors, like myself, who are generally healthy and living productive lives, things like wearables and real-time monitoring solutions that address medication non-adherence, early cognitive decline or emerging health issues, new technologies will certainly play an increasingly larger role in our lives than it has for past generations of seniors. That’s where all the major innovation is happening.”

The Politics of Seniors Care

Many close watchers of health care policy caution that although the public sector will always lag behind private insurers and providers, sheer demographics dictate that sweeping change in Medicare and Medicaid programs is inevitable. Bradley Honan, a veteran political consultant and pollster who has worked on presidential campaigns for both Bill and Hillary Clinton, as well as for other high profile politicians such as Michael Bloomberg and Tony Blair, views the impact of an aging boomer population as perhaps one of the biggest underreported stories affecting government at the federal and state levels.

“The pressures will be enormous,” observed Honan. “The U.S. government is largely underprepared to respond to what will amount to be the biggest advocacy group in the history of the country. Seniors are much more likely and dependable voters than any other age group, and as Boomers become senior citizens, you can expect that they will demand that policy coming out of Washington and state capitals across the country address their prime concerns which, in most cases, will be related, either directly or adjacently, to health care.”

“The emerging revolution in senior-focused technologies that can better engage and serve senior populations cannot—must not—be seen as something that is the sole domain of the private sector, specifically private health plans,” cautioned Honan who runs the New York City-based Honan Strategy Group, a company that has chiseled out a unique space in the market that merges political consulting with corporate market research and analytics. “If national and local policymakers take too long to understand and embrace all the innovation happening in private senior care, they will be, albeit inadvertently, exacerbating a new digital divide between senior have and have-nots, in this case with life and death implications—and political ones eventually as well.”

Lifesprk’s Theisen concurs with Honan’s assessment. “The societal pressures will be unlike anything we have seen, and, as an industry, we need to get ahead of this; now is the time to attack the poor performing, fragmented, reactionary, expensive ‘sick care’ system that has failed our seniors for far too long. COVID-19 is ironically acting like a catalyst to push the industry out of its comfort zone, accelerating many powerful innovations that deliver much needed community-based alternatives. People deserve and will demand better.”

Doctor-Recommended Tech

As the market dynamics play out and with political and demographic pressure pushing for a top-down deployment of resources, while increasingly tech savvy seniors and their families push for more bottom-up innovation, a third, and perhaps the most influential, constituency is priming the pump of technological innovation in senior care: physicians.

Increasingly, technology in health care is adopting to the patient or user, not the other way around.”

Across the health care sector, telehealth—a catchall phrase referring to the emerging ecosystem of digital and virtual health platforms that allow patients and doctors to connect either in synchronous (i.e., live) consultations or asynchronous exchanges—was beginning to reach mainstream adoption prior to COVID-19, although it was largely seen as something of a novelty or a convenience at best. But this all changed when the risk profile of in-person visits eventually gave way to virtual interactions as the pandemic spread across the U.S.

According to recent research from Accenture, prior to the coronavirus, younger generations received virtual health care more than twice as frequently than elder generations, notes Brian Kalis, managing director of digital health and innovation for Accenture’s health business. Accenture saw that broader adoption of both synchronous and asynchronous consultations among the elderly really picked up once physicians began actively recommending virtual care. “That was the turning point,” commented Kalis. “Virtual health care services became a necessity for millions of American as efforts to slow transmission of COVID-19 sharply limited face-to-face visits with doctors and other care professionals. Seniors trust their doctors, and when clinicians began encouraging seniors—for their own protection and safety—to go online and try virtual care, many found the experience a lot less intimidating than they were expecting.”

“Health care organizations are increasingly using human-centered design to develop services that leverage emerging tech, like voice technology and camera sensing—all tailored to the needs and wants of seniors and the senior care market,” added Kalis. Increasingly, it would seem, technology in senior care is adopting to the patient or user, not the other way around.

“Boomers get it—they have been on the internet since the days of AltaVista, Ask Jeeves and AOL.”

“There is no question that the senior care industry is in flux,” said Jeff Fritz, CEO of Revel Health. “While a number of companies are laying the foundational track with the technology that will enable them to prescribe better models of aging and geriatric care, we as an industry have to recognize that understanding what needs to happen and getting seniors to follow that plan are two entirely different challenges.”

To that end, Fritz and his team have found some surprising insights about how seniors adopt and respond to new technologies and digital messaging techniques. “We have found that the multi-channel approach, including digital channels, works incredibly well for the Medicare Advantage population,” said Fritz, referring to those seniors who receive Medicare benefits through a private-sector health insurer.

“SMS notifications seem to really spark engagement from this cohort. I think with time, as the tools for digital engagement evolve, we will find that there is very little that most seniors will not be able to handle when it comes to the technology that will be part and parcel of their health care experience,” continued Fritz. “Revel programs show that 60- to 80-year-olds are more digitally savvy than we often expect.” Punctuating that point was a recent Revel study that showed seniors are the most likely to engage with text-message engagement tactics—far more than all younger cohorts.

Senior-Friendly Tech

Whereas companies like Lifesprk are largely focused on charting the data surrounding a senior to prescribe better and lower cost care models, the delivery of that care isn’t tech intensive per se; Lifesprk’s premise is that the technology drives how the care is delivered, not that technology is intrinsic to care delivery. Lifesprk doesn’t necessarily begin with the premise that seniors themselves need to be particularly tech savvy.

Nevertheless, the senior-friendly tech market is one of the fastest growing segments in consumer electronics. In the past couple of years, Best Buy acquired GreatCall, which develops an array of built-for-seniors technologies including smartphones, smartwatches, medical alert devices and other devices for this growing segment. Investment bank Morgan Stanley lauded the GreatCall acquisition, stating that “Best Buy is at the edge of a significant, untapped white space opportunity in health care,” while Forbes speculated that health care may eventually emerge as a bigger business for the company than selling electronics.

Another company that has seen explosive growth in the last mile of senior-focused technology is Los Angeles and Minneapolis-based GrandPad, which makes senior-friendly tablets that not only enable family members to keep tabs on their loved ones, but also fulfills a panoply of mission-critical services for what company cofounder Scott Lien calls the “super seniors”—those 75 years old and above. From facilitating virtual doctor visits to making it easy to order a Lyft to get to church or the supermarket, GrandPad is not an app that runs on an iPad, but a customized tablet manufactured by Acer designed with the senior user experience top-of-mind. With front-facing speakers, always-on connectivity, wireless charging and a simple interface, GrandPad has sold nearly 100,000 units and recent partnerships with enterprise health care heavyweights, like Kaiser Permanente, UCSF School of Medicine and in-home senior care giant Home Instead, have put the company on a path to dominating the senior-focused smartphone market.

“The most interesting part about what we are doing happens largely behind the scenes,” commented Lien, the CEO of Grandpad. Lien is a Silicon Valley veteran who started the business with his son initially as a way to connect to Lien’s aging mother who lived back in the Midwest. “Once all the consents are in place, everything is measured, and within a few weeks, we can establish a baseline of usage and engagement and identify even tiny deviations from that baseline which may indicate signs of nascent health issues or cognitive decline. The data we collect and analyze from performance in games like Solitaire or social interaction data can help caregivers intervene and address health issues faster and more effectively than through traditional health care delivery models.”

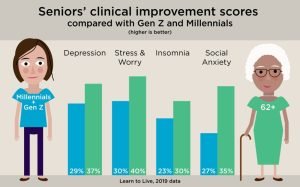

Online digital therapy for seniors is another burgeoning area in the senior healthtech sector. One company that has found remarkable success in helping seniors is Minneapolis-based Learn to Live, a leading online mental health platform that delivers cognitive behavioral therapy to address issues like anxiety, substance abuse, loneliness and other disorders. Learn to Live has seen impressive engagement from its senior demographic, who have also demonstrated the highest psychometric improvement from the online programs. “Our members aged 62 years and higher are clearly not afraid of technology. They engage at a rate on par with younger generations and achieve stronger outcomes,” said Dale Cook, Learn to Live’s CEO and cofounder. “They’re remarkably engaged, using our programs across all the different platforms—computers, tablets and smart phones.”

“Amazingly, seniors respond really well to online therapy—better than any cohort on our platform” added Cook.

It seems logical that future generations of seniors who regularly used and, in fact, depended on technology earlier in their lives will continue to do so later in life. “There’s been this myth that older adults aren’t online, they don’t buy things, they don’t change their behaviors, and I think that’s fundamentally changing,” said Primetime’s Abby Miller Levy in a recent interview with CNBC.

Fox Business’s Bearman seconds Miller Levy’s take, adding: “Of course the seniors of the future are going to be more tech savvy than their predecessors—most of whom had minimal exposure to high tech during their adult lives. Remember, Boomers get it; they have been on the internet since the days of AltaVista, Ask Jeeves and AOL. Just because they’re not on TikTok or Snapchat doesn’t mean they don’t get technology. And if their doctor is saying ‘download this app’—you can bet most of them will do it.”

But the rush to pour money into consumer-facing, senior-focused tech is tempered by a handful of health care investors who are eyeing a handful of truly paradigm-shifting technologies as the ones that will eventually upend the over-65 health market.

“There are a lot of flashy ideas out there focused on the senior market,” remarked Alex Turkeltaub, founder and former CEO of San Francisco-based Roam Analytics, “but I would place my bets in senior tech on three main areas: smart homes, mental and behavioral health platforms, and ‘hospital-in-the-home’ services.” Turkeltaub, who now runs Washington, D.C.-based JSL Health Capital, an investment firm focused on the intersection of AI and health care, is bullish on categories of service that will rely on AI to collect, analyze and act upon reams of structured and unstructured data, but less convinced that technologies that force seniors to use and directly interact with technology will gain much traction.

Turkeltaub believes that the market will begin re-imagining senior living facilities to create true ‘smart homes’ that not only inform us about whether ‘grandpa went to the bathroom’ but will also provide data to intervene before adverse events occur. This new tech will allow seniors to benefit from the ‘smartness’ of their home, enabling them to easily order food, share their medical concerns and find companionship—all via voice controls. Second, he sees mental and behavioral health platforms that utilize telemedicine to proactively identify and treat loneliness, depression and other conditions that correlate highly with poor health outcomes as an area that will be gaining a lot of traction in the next few years. Third, he has identified companies offering ‘hospital-in-the-home’ services, from blood tests to surgical procedures at the senior’s home, that save time and drive superior outcomes, as being a massive area of untapped potential.

Senior Care Delivered by Humans, Not Technology

Despite all of the fanfare when it comes to heralding a new era of tech-enabled senior care, the trend does have some rather noteworthy skeptics. Dr. Edward Bergmark, who founded Optum, the health care solutions unit of UnitedHealth Group, is one of them. “Even if you have sophisticated data science running in the background, transforming those insights into actual changes in prescriptive care is next to impossible,” said Bergmark. “Yes, some companies will make money, but saying that the same types of technology that have revolutionized, say, e-commerce, are now going to upend the elder care system over the next few years—call me a skeptic—but I’m not seeing it.”

Veteran health care analytics executive Timothy Pearce, who currently heads up the data and analytics arm of Minneapolis-based Livio Health, a company which focuses on palliative care for people with a range of serious illnesses including pain management and emotional support, tends to agree with Bergmark’s assessment. Pearce believes that advances in technology itself will be of limited use when it comes to senior care.

“Throwing technology at senior care isn’t going to solve anything unless it goes hand in hand with in-person care,” commented Pearce. “That being said, even if the insights that can be gleaned by using data and advanced statistical approaches are minimal, the impacts will be meaningful as long as there is a comprehensive plan to getting that in the hands of clinicians and care workers.”

“I get that there are a lot of new technologies out there, but at the end of the day, technology comes down to engineers and programmers,” noted Bergmark. “If you graduate at the top of your class in computer science at Caltech, are you going to work for Elon Musk at SpaceX or for some senior-focused data company? I don’t mean to diminish seniors—I am one myself—but the reality is that the best technology minds are not focused on solving senior issues, which means senior care will always follow whatever advances are happening in the general market.”

Bergmark believes that many of the venture firms pouring money into investments in the senior space are misreading the marketplace. “Of course, demand for senior services is high and it’s a huge and expanding market, but there is too little money in it. More people are staying alive longer, but very few have appreciable savings. If families cannot provide support, and there is a necessity for a payer of last resort, it will always fall to a government program to pay—and they are not typically known for their generosity.”

Bergmark and Pearce are part of a chorus of long-time health care insiders who believe that until senior care can be fully automated with robots and other next-generation solutions—all of which is likely decades away—the last mile of care will always be delivered by human beings, which caps the impact that advances in technology can have. “Let’s be honest—it’s an unforgiving, tough job that very few want to do,” stated Bergmark. “Those of us who have provided such care for our own families are all too aware of the enormous physical and emotional challenges the work presents. For those who do such work for pay, why do you think the ranks of senior care specialists fall largely on the shoulders of unskilled workers who have few if any other options and are making close to minimum wage? It’s because people with options would rather not have to care for seniors. It’s important work but too often thankless—emotionally and economically.”

Home Sweet Home

Bergmark’s skepticism notwithstanding, the industry as a whole, is plowing ahead. According to Lisa M. Cini, a renowned authority on senior-focused design and author of BOOM: The Baby Boomers Guide to Leveraging Technology, So That You Can Preserve Your Independent Lifestyle & Thrive, the entire senior ecosystem is cruising towards something she calls ‘Amazon Senior Care’—shorthand for an on-demand, geo-agnostic future where seniors have access to whatever they need wherever they are, supported by an array of interconnected technologies that provide a seamless user experience. “Home health agencies and senior living providers will have to up their game and meet seniors where they are versus having the seniors come to them and bend to their rules,” says Cini. “Amazon Senior Care will open the doors for multi-generational living.”

The way in which technological innovation is meeting advances in senior care delivery in the sector is perhaps best captured by Miami-based Papa, a tech-enabled senior service with big-name backers, such as Reddit founder Alexis Ohanian, actor Ashton Kutcher and entertainment empresario Guy Oseary. Papa addresses one of the biggest gaps in the senior care sector: in-home care providers. According to Papa CEO and founder Andrew Parker, the U.S. geriatric sector will need eight million senior home care professionals by 2026, and there is nowhere near enough supply to meet that demand.

The home is better for health and care in nearly every way.”

Papa uses sophisticated HIPAA-compliant technology to deploy “Papa Pals,” vetted helpers – oftentimes college-age kids who health plans can dispatch to seniors to perform a variety of generalist daily tasks or, in health care parlance, Instrumental Activities of Daily Living (IADLs), from doing the laundry to accompanying their senior pals to doctor visits. “You can think about Papa as really ‘family on-demand,’ or ‘grandkids on-demand,’” explained Parker who is working with over 20 different health plans nationwide. “We are fulfilling a critical need in the eldercare space that enables stay-at-home seniors to lead more fulfilling and productive lives while addressing many of the social determinants of health.”

Whether it’s new technologies in the home or technologies that bring more services to the home, all indications are that the home will be the hub of senior-focused care in the future.

“The elder care model will be much more centered around the patient in five to 10 years. We have a health and care infrastructure that’s struggling to keep up and one that’s too fixated on the health care delivery mechanisms of the past,” mused Christopher McCann, CEO and cofounder of Boston-based Current Health, a leading FDA-cleared, artificial intelligence-powered remote patient monitoring platform. “Rather than bringing the patient to the hospital, hospitals will provide health care to them in the home at the point they need it most. The home is better for health and care in nearly every way.”