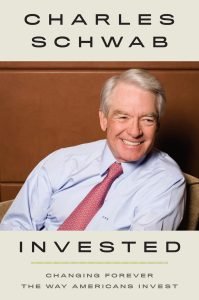

Charles Schwab is legendary for making investing and saving for retirement easier for everyday Americans. The chairman of Charles Schwab Corporation and author of several books, he’s releasing Invested: Changing Forever the Way Americans Invest, a memoir about his life and building Schwab into what it is today. The book, out next week, will be excerpted on Worth.com next week and in Worth later this fall.

Q: Although you’ve written a few books, a memoir is a departure from previous subjects. Why choose to write it now?

A: I’ve always had a purpose in mind—how can I make things easier, better, more successful for the individual investor. I hope readers will see the consistency in how we made the decisions that created Schwab over the 40-plus years covered in the book with that purpose in mind. Now that the company has been around long enough that I can tell that story in complete way, through all the challenges and triumphs that came with trying to build something lasting, I thought it was a good time to tell the story.

A: I’ve always had a purpose in mind—how can I make things easier, better, more successful for the individual investor. I hope readers will see the consistency in how we made the decisions that created Schwab over the 40-plus years covered in the book with that purpose in mind. Now that the company has been around long enough that I can tell that story in complete way, through all the challenges and triumphs that came with trying to build something lasting, I thought it was a good time to tell the story.

I think knowing about that consistency and the spirit of the place is important for employees, for clients, or anyone who may be interested in this industry. That foundation will be the basis on which this company will exist for many years to come, and I wanted people to be able to see the story through my eyes.

In many ways, it is also a chance to recognize and thank the people that helped make the dream a reality. As I say in the book, it was really one thing that brought us success: A zealous team of people on a mission that I fondly refer to as Chuck’s secret sauce, all in lock step trying to make investing better for the investor.

How did you approach the writing process? Where did you start?

I started by thinking about the themes that have consistently driven us at Schwab: the challenges of growth, being an entrepreneur, risk taking and risk control, leadership, teams, innovation, challenging norms, focusing on clients and the incredible opportunities available in a system like ours. Our story is ultimately all about those things, and I tried to collect moments in our history that bring them to life.

The excerpt we’ll run comes from the chapter about Schwab’s IPO. What other milestones do you feel are the most important in your career?

The earliest was realizing relatively young that I could overcome some serious challenges that came with dyslexia, even when I didn’t know that was what made learning so hard for me. Ultimately, I was able to use those challenges to my advantage.

Then, discovering the work that I was passionate about was very important to my success. I love investing and the opportunity it presented, which made the hard work of building the company easier. The importance of finding passion in your career is why I encourage young people to learn what it is they are good at and put their energy there.

Learning early on to build things that our clients would love and that made them better investors served me well time and time again.

Beyond that it was step-by-step from one challenge or opportunity to the next. Learning early on to build things that our clients would love and that made them better investors served me well time and time again even to this day.

What’s next?

Through the many miracles of modern medicine people in America are living longer, which means we’re dependent far longer on investments and savings to take us through retirement. Social Security won’t and can’t cover everything we desire. When the average life expectancy was 65, planning for retirement wasn’t as important. Now, you’ve got this 20- or 30-year period you have to be ready for. Longer life is a great gift, but also a challenge, and I think you’ll see many firms putting focus there. How do you make the most of your savings and do it in a way that is dependable and relatively easy? Today, that is still a struggle for many. It’s an important problem to solve.

And for me personally, helping younger people gain financial knowledge and engage in their financial life early has always been very important. It boils down to education or the lack of it. Most schools don’t teach the elements of why a financial life is so important. We don’t do enough in our country to foster financial literacy, and more focus has to be put there in schools and at work. Because in our system of free enterprise the government is not going to take care of all your needs, so you have to be responsible for taking care of a big chunk of your life.