For most investors, bonds represent a foundational piece of a diversified portfolio. A fixed income allocation can serve multiple purposes—acting as a source of income, a hedge against periods of downside equity market volatility, a source of liquidity and a means of diversifying portfolio returns away from equity market risk.

But investors in today’s low-interest-rate environment are keenly aware that finding a balance between yield and risk is difficult—perhaps the greatest current challenge presented by conventional fixed income investments in the portfolio.

To further illustrate, at the beginning of 2021, 10-year U.S. Treasury Bond rates were just above 1 percent, investment-grade corporate debt was priced at negative real (inflation-adjusted) yields for the first time in history and 30-year mortgage rates were at historic levels as low as 2.65 percent. Although interest rates are seeing a notable uptick as inflation expectations grow, they remain near historical lows.

This may leave fixed-income investors asking whether there are other bond replacements or potential income sources to supplement their existing fixed income portfolio.

Alternative Strategies to Traditional Fixed Income

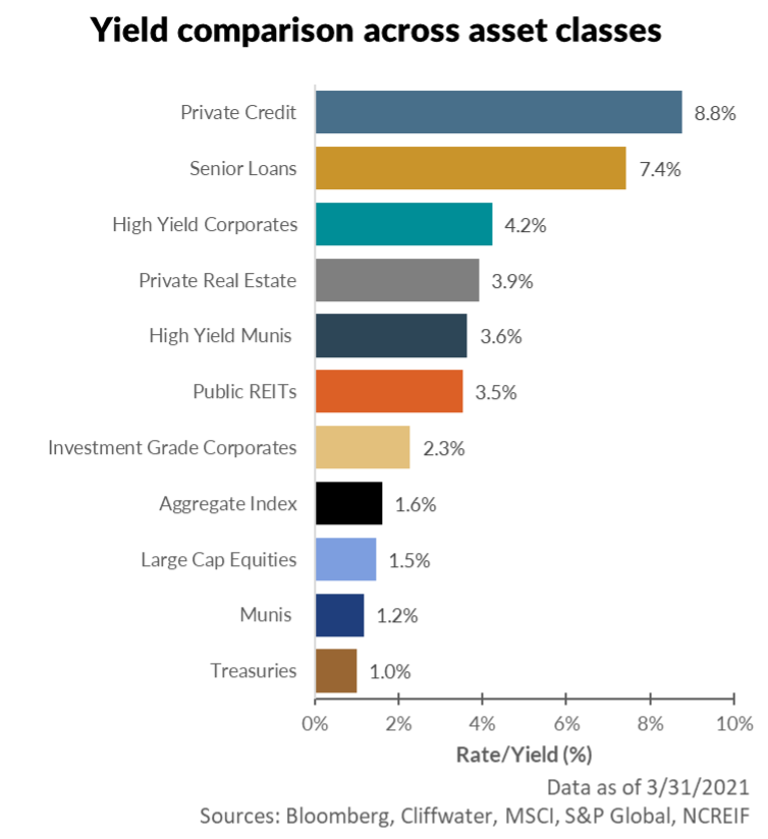

Outside of traditional bonds, investors have a variety of options to consider as supplements to fixed income that offer higher yields and/or uncorrelated returns. However, these opportunities require trade-offs that can include more risk, reduced liquidity, less transparency, higher leverage and additional portfolio complexity. Investors should carefully consider each of these risks prior to investment.

Alternative strategies may include:

- High-yield opportunistic credit: Noninvestment-grade corporate and municipal debt, defined as bonds rated below BBB- or Baa3 by established credit agencies, can offer investors a higher yield than government bonds or high-grade corporate and municipal credit. These markets can also provide opportunities for active managers to add value through credit selection and downside risk management. Skilled management in this space is beneficial to reduce the risk of defaults or restructurings that could be costly to investors.

- Private credit: Investors are increasingly extending loans directly to firms seeking to bypass financial institutions—a trend that has been rapidly growing since the 2008–2009 financial crisis. Private credit is typically offered to smaller businesses with earnings below $100 million. A majority of this capital is allocated to private credit funds specializing in direct lending and mezzanine debt, which focus almost exclusively on lending to private equity buyouts. Investors have been attracted to private debt due to its higher yields that range from mid-to-high single digits. Some funds may further enhance these yields through the use of leverage. These investments are highly illiquid and may present further credit risk, making skilled management particularly critical.

- Real estate strategies: Real estate can offer a stable, growing source of income from the cash flow generated by the property assets. Investors can consider equity or debt exposure to real estate investments across a range of risk levels. Core or core-plus private real estate funds invest in stabilized real estate with moderate leverage across various subsectors and geographies. Returns are mostly driven by income, which generally delivers mid-single digits annually. There’s also potential for modest property appreciation, especially in an inflationary environment. Real estate debt strategies can vary across capital structures and lending solutions, but generally involve the purchase of structured real estate-related assets, such as residential and commercial mortgage-backed securities.

- Insurance products: A number of insurance-related products held within life insurance and annuity vehicles may offer a higher rate of return than the current yields offered by the bond market while also providing some level of principal protection. Life insurance death benefit as an investment and cash-value life insurance and annuity products are a few areas to consider in today’s interest rate environment. Investors must understand the caveats to these vehicles, such as illiquidity/surrender penalties, fees, investment time frame and other product-specific considerations before committing to an investment.

- Hedge fund strategies: Hedge funds vary broadly in terms of their risk-and-return targets, but many reputable managers employ diversified, uncorrelated strategies with exposure to equity, credit, commodity and derivative markets. Additionally, some hedge funds employ trading-oriented strategies with less reliance on market direction, which may further add diversification to a portfolio. Credit-oriented hedge funds often specialize in complex debt arrangements and structures that are less dependent on the direction of interest rates or credit markets. However, investors in hedge funds will typically be subject to stricter liquidity terms than in traditional investments.

The low interest-rate environment has created unique considerations across the entire investment landscape, which may last for some time to come. Rates in developed economies have been low for an extended period, and investors seeking higher yields may want to consider various alternatives to their traditional fixed income holdings to enhance return potential. Although traditional fixed income assets are still a critical building block in a diversified portfolio, investors who are comfortable with the additional risks associated with various alternative strategies may find viable solutions to meet future goals and return targets.

Clearly, alternative solutions can enhance income generation and return potential relative to core bonds, but may introduce additional risks, cost or complexity to a portfolio.

Investors considering such strategies should recognize that the increased yield comes at a price. Whether that price is worth paying depends on the goals, objectives and risk tolerance of the individual investor. Assuming the hurdles can be overcome, these options can be attractive additions to a diversified portfolio seeking to enhance their portfolio yield and potential return.

Jim Baird is a CPA, CFP®, CIMA®, CIO and partner at Plante Moran Financial Advisors. Doug Coursen is a CFP® and principal at Plante Moran. Jeremy Kedzior is a CFA and alternative investments strategist at Plante Moran.