Working for Silicon Valley giants like Google and Zynga taught Andy Tian a lot: mostly what not to do. Too many tech companies treat the world as one big market, but one size does not fit all when it comes to serving emerging markets. As the CEO of Asia Innovations Group (AIG), Tian has focused on delivering services that are localized, customized and moderated for the specific cultures and countries where their customers live. The strategy has made AIG a giant on the global landscape, with more than 500M users in 150 countries.

Initially starting with dating and live social apps, the Singapore-based company now offers payment, gaming and e-commerce services throughout India, the Middle East, Africa and Latin America. AIG is thriving as a business with a billion-dollar valuation and backing from A-list investors like Kleiner Perkins and Ventech. But perhaps most importantly, by empowering and paying local content producers, AIG has helped raise the standard of living for thousands of users across the globe.

Worth’s Arick Wierson caught up with Tian to discuss AIG’s financial success, unique business strategy and global impact.

Arick Wierson: Andy, thanks for agreeing to share with us the AIG story. The success you are finding is truly phenomenal.

Andy Tian: Absolutely. It’s my pleasure. And yes, I am so proud of what the team here has achieved. But in reality, we have just gotten our sea legs beneath us. The first decade was about building out infrastructure and capacity across our core regions and getting the product mixes right. The next step–what we’re doing right now–is to throttle up.

Wierson: You know, AIG–not the insurance company of course–isn’t really that well known here in the US–at least outside of Silicon Valley. Do you see that changing?

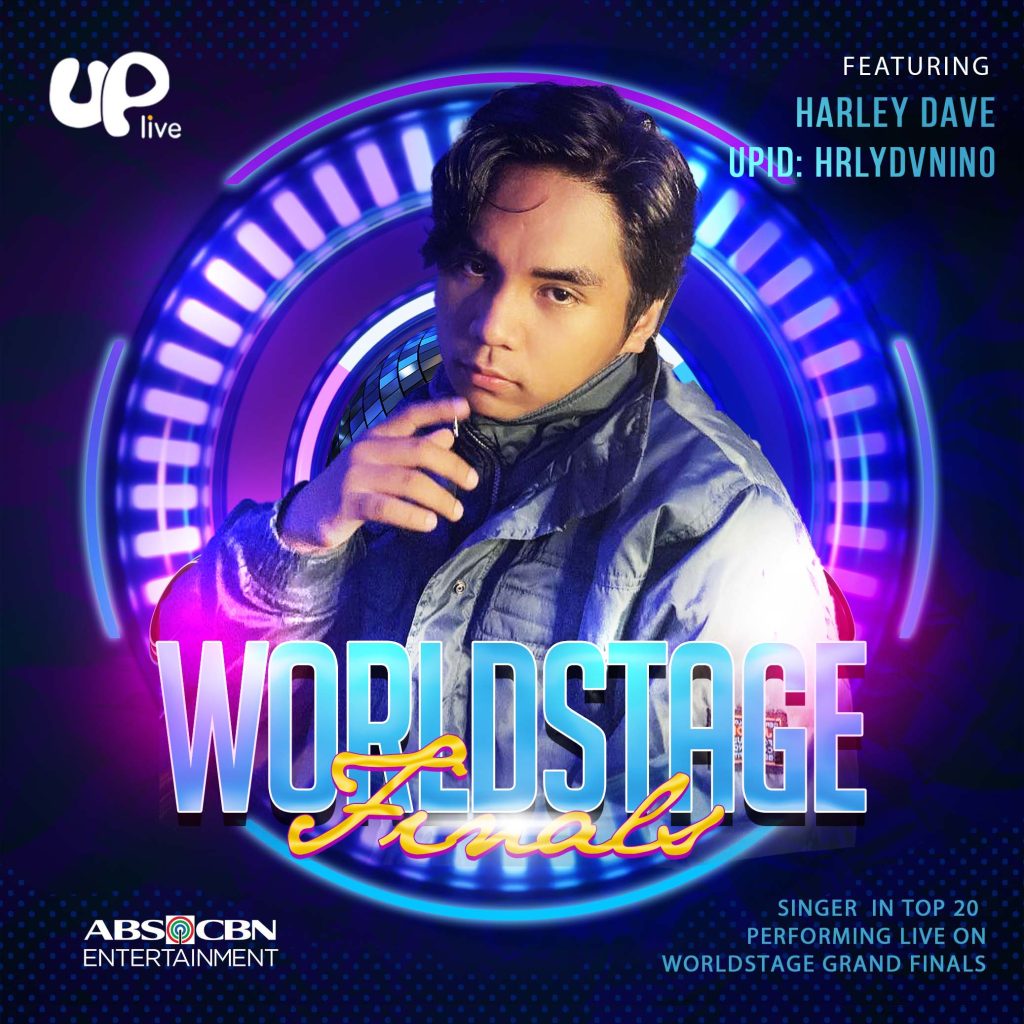

Tian: It’s not well known yet. But you make a good point. A lot of our individual and institutional investors are US based, so we are well known in certain tech and financial circles, but the company itself hasn’t really made a big push in the US yet, as our focus is on emerging markets outside the US. I think that more than the AIG company name, certain AIG properties such as Lamour and CuteU, our popular dating apps, and Uplive, our marquee live streaming property, have already penetrated the US in a significant way–just by the sheer nature of us operating in a globally connected environment. Put another way, you may not know AIG, but your 17-year-old at home probably knows a fair amount of our brand’s properties.

Wierson: She probably does! Tell me some more about the breadth and reach of some of AIG’s platforms.

Tian: Sure. I think it’s important to talk about them by sector. First up is a family of platforms we call Live Video and Voice Social. Here we have Uplive, one of the largest independent live video social entertainment platforms in emerging markets with more than 300 million registered users and 22 million creators. And then, we also have Haya, which is a live voice social app dedicated to users who prefer to socialize and interact without using a camera.

Wierson: Haya is sort of like Club House?

Tian: Yes and no. Live voice mobile apps have been in Asia for the last ten years, so Haya’s foundational principle is based on specific cultural norms in certain areas of the Middle East and Asia where face-to-face interaction is either uncomfortable or discouraged. It’s like Club House in some respects, but it serves a much more critical societal and cultural function in some parts of the emerging markets in which we operate.

Wierson: And what about dating? I wrote a piece about Lamour just ahead of the much-anticipated Bumble IPO last year. At the time, Bumble was gung-ho about moving into markets like India and elsewhere in Asia. From what I can tell, it hasn’t been smooth sailing for the US dating app.

Tian: Well, I am always reluctant to comment on our competitors or others operating in our airspace. I wouldn’t want their CEOs talking about us but, what I can say more generally is that many Western dating apps have tried to essentially copy and paste their tech and UX–features that have been quite successful in places like the US and Western Europe–into Asian and Middle Eastern markets that are oftentimes governed by vastly different social and dating norms. In fact, as you pointed out in your piece about Lamour, the mere concept of ‘dating’ as we understand it in the West is something of an anathema for many people in more conservative countries. And not only in Muslim nations. In some parts of Asia, dating rituals are oftentimes much more of a family affair. And that’s what most western dating apps fail to grasp. And I think that is where our mission of providing not only culturally appropriate localization apps as well as protection comes into play.

Wierson: Can you expand on what you mean by ‘protection’?

Tian: AIG doesn’t see social media as a free-for-all. There must be guardrails. Otherwise, an online utopia will quickly descend into something akin to a digital dystopia. There are firm ground rules not only on dating apps but across all our social media platforms. We will not allow ourselves–as has happened to many of our social media counterparts in the US–to become hijacked by groups with particular extremist, religious, or political viewpoints, all in the name of “free speech.” We want to empower our users and creators to have freedom of expression, but not if that expressiveness leads to division and the derision, exclusion, or marginalization of others. If you want to talk politics or religion, that’s fine, but please do not disparage other political or religious beliefs. Our platforms are about community and inclusion. We’re dedicated to supporting creators but in a safe and protected environment.

Wierson: How does that impact Uplive? Companies like Meta with its Facebook and Instagram apps, as well as others like Snapchat and Twitter have been getting skewered in the media in recent years.

Tian: The US style of social media is another type of pandemic, but unlike COVID-19, there is no vaccine at the ready.

Wierson: There’s no getting that toothpaste back in the tube?

Tian: It’s a tricky situation in the US, and that’s because the leaders of most social media companies in the US took a hands-off, laissez-faire approach to managing the discourse on their platforms. It’s fine to have a ‘town square’ such as a public access TV channel but even there you can’t let crazies spew hateful messages or conspiracy theories for days on end. You step in. You moderate.

Many of our investors are leading executives in Silicon Valley, including co-founders of well-known companies such as Instagram, Zynga, etc. I was at Google and Zynga, so we have firsthand experience of how US social platforms have taken on lives of their own. We didn’t want to become a platform for body shaming and so many of the other things that Instagram, for example, has turned into in recent years. It was a brilliant app with the best of intentions and still has a massive influence, but with inadequate protections in place, the negative impacts have erased much of the good that was the goal of the founders. And Facebook, of course, has an even bigger problem with even bigger damages already incurred.

Wierson: Now let’s talk about CuteU for a moment. You are seeing very high growth there.

Tian: Yes–really excited about this high-growth dating app we launched. After all the success of Lamour, we wanted to launch a second-generation dating app that focused more on online live social interactions, with the real-time matching between global users. It is really targeted at a younger generation with a more fun interface in a safe, protected environment. No one dating app has a “one-size-fits-all” capability.

Wierson: That’s so exciting. Now switching gears for a moment, let’s talk about all the economic empowerment that is happening on many of AIG’s platforms.

Tian: Thanks for asking about that. Uplive has actually become a vector of change and social good in many key emerging markets. And it’s not some ultra-niche product. It now holds the number one or number two position for live video apps in all of the nearly 50 key markets we serve. Not only is it a platform that fosters connectivity with fellow community members in a protected environment, but it has become a powerful tool of economic empowerment. Uplive is literally helping millions of creators supplement their income and in doing so, empowering many of them to lift their families out of poverty.

Wierson: That is really remarkable. Tell me more about that.

Tian: Uplive is probably our best-known property and the one that allows video social streamers to broadcast their talents and build connections in real-time with users across the globe. To date, we have over 22 million creators who have been paid out hundreds of millions of dollars in compensation for their work on the platform. To put this in context, nearly 90 percent of our creators are from so-called “emerging market countries,” and 58 percent make less than $200 a month. For example, in Egypt, once a creator on Uplive has gained 5,000 fans, they can earn an average monthly income of $187, while only having to spend 5 hours a week on average streaming in Uplive. In comparison, the minimum monthly wage of a full-time job in Egypt is $125.

Wierson: That’s amazing, and, as you alluded to, it’s not just the creator who is being lifted out of poverty; it’s an entire family unit.

Tian: Yes, on average, our creators in emerging markets live with 7-8 family members. Their streams and creations on Uplive are really lifting up the entire family.

Wierson: So that’s AIG’s approach to ESG.

Tian: Yes, it is a large part of it. At AIG, our guiding principles are, just like our acronym, “Advance, Impact, and Guard.” Generating much-needed part-time income is the ‘Advance’ principle, and it is the most important one. You know, young companies are so busy trying to survive that they don’t have time to really think about ESG. But then you get to a certain point; you are almost too big to be able to ignore ESG. Investors always want to know what you are doing when it comes to these sustainability metrics.

But as we thought about ESG–environmental, social and governance–the “S” in ESG really spoke to us the loudest. We could have hired amazing copywriters to talk about our carbon-neutral goals for 2030, but we opted to dig in where we are really making a real difference. Take, for example, our payouts to creators, which have grown on average 135 percent over the last few years. That means we are on track to generate nearly a billion dollars in annual payouts to creators in the next few years. That’s a lot of income being funneled back into underprivileged families across the developing world.

Wierson: I saw a recent report from Oxfam that said COVID-19 would push an estimated 263 million people into extreme poverty by the end of 2022.

Tian: Right? If anything, ESG needs a rebranding–maybe we should reorder the letters and call it SEG–the ‘S’ should come first. Who will care about your carbon footprint if you don’t have enough to eat? In terms of orders of importance, people need to have their basic life needs to be met if you want them to care about global warming and climate change.

Wierson: SEG–I like that.

Tian: Look, it’s fairly clear that China is no longer an emerging economy. But even removing China from the equation, nearly 4 billion people still live in so-called emerging and low-income countries. These are AIG’s markets. And this is where the growth is happening. I am not saying that climate change is unimportant. Not at all! But, if we have a huge percentage of the global population still living on a few dollars a day on average, how can we expect to address climate change en masse? The ‘S’ should come first in my opinion. Social and then environmental.

Wierson: Talk to me about the infrastructure rollout in emerging markets. As someone who lived many years in Angola and Brazil, I can tell you that last-mile delivery, depending on where you are, could just as well be the last one hundred miles.

Tian: Great question. 3G and 4G mobile coverage are still growing at an astounding rate across the developing world. Smartphone adoption is growing at 16 percent a year. And unlike in the West, the majority–54 percent to be exact–are mobile-only users. They don’t have a PC or Macbook at home. They literally live off their $40 smartphone. As such, we have designed and optimized our apps to thrive in this environment.

Wierson: And what about the other pillars of basic infrastructure? Banking, logistics, etc.

Tian: Right. That’s why we have moved into payments, a key enabler for consumer services, including e-commerce. We had to create an integrated, all-in-one middleware platform for connecting various localized payment solutions in emerging markets for all of our AIG products. We had to do the hard work of developing ways for people to use their phones to be able to pay locally for products. Uppay is our main payments platform that integrates over 70 payment channels across the markets we serve.

And now, with a robust payments solution in place, we are rolling out e-commerce and marketplace products. Hekka, for example, is our first major online shopping marketplace, featuring the best quality consumer goods we source and manage ourselves directly–no intermediaries.

Wierson: We haven’t talked about gaming.

Tian: Yes, that’s true–gaming is a huge area of focus for us. And it’s a critical piece of the ecosystem we are building. Our gaming division is called Minerva, and it’s responsible for publishing engaging games that feed into and leverage our social media and payments platforms. Like our emerging e-commerce offerings, gaming is part of building a complete mobile consumer ecosystem.

Wierson: I am fascinated by the vastly different approach AIG and other internet players born in Asia are taking as opposed to US companies that were and still are so focused on discreet businesses. Meta, aside from Whatsapp, is largely dominant only within the confines of social media. Google is the king of search. Amazon is e-commerce and AWS. Every time they have ventured out of their comfort zone, they have failed.

Tian: I worked in Silicon Valley for many years, and it was clear to me that the mentality and the environment surrounding the Northern California tech space rewards focus, growth of market share, and pure users over revenue and profitability.

Remember reading about how Facebook debated internally about when the company should–if ever–start seeking revenue? Well, in emerging markets, we don’t have this big robust VC community bankrolling entrepreneurs to grow market share and refine their tech over a long period of time. Here in Asia, there is venture capital, but it is part of a system and culture that demands an immediate and clear path to revenue and profitability. And across emerging markets, different consumer products monetize at different levels–there isn’t a huge online ads pool of money to tap into like there is in the US. So, we need to build a mixed business architecture with strong synergies among its own components to generate both user and revenue growth sustainably.

Wierson: Finally, let’s talk about AIG becoming a channel for cross-border gifting.

Tian: AIG is likely the largest privately-held mobile consumer company across emerging markets–and the only one that is both multi-regional and multi-vertical. And as a result, with this vast community of users, we have emerged as a bridge between advanced economies and emerging markets. For consumers in emerging markets, brands and services from advanced economies such as the US are still seen as high quality. For example, entertainment content from the US has a huge following across most emerging markets. Therefore, it has been one of our key strategies to leverage US resources and influence to serve emerging markets better.

Our US office in Dallas, Texas, has not only fostered the growth of AIG products such as Uplive in the US but has also driven growth in the Philippines and Latin America. In another example, in the Muslim world, we have become a powerful vehicle for sending Zakat, the Islamic practice of almsgiving, worldwide. We think this platform use is terrific and fosters even more connectivity by enabling users with means in advanced economics to contribute positively to underprivileged creators in less developed regions.

Wierson: This has been great. Congratulations on all your success. And for making such a big difference to those who need it most.

Tian: Arick, it was great talking with you, and I look forward to keeping you and Worth abreast of our story as we continue to grow.