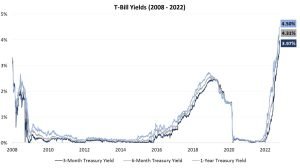

Whether for taxes, a home down payment, or otherwise, investors may need to hold sizable amounts of cash at times. Throughout the 2010s, opportunities to earn any meaningful yield on that cash didn’t exist. As interest rates have risen throughout 2022, that has changed.

Investing cash in short-term U.S. Treasuries (T-Bills) hasn’t been this attractive in 15 years.

T-Bills Then and Now

T-Bills aren’t new – they’re bonds issued by the U.S. government maturing in 1 year or less. They also happen to currently be one of the best short-term options for enhancing the yield earned on your cash in a safe asset.

The average 6-Month T-Bill yield from 2008 – 2021 was a paltry 0.56%. Today, holding a 6-Month T-Bill will earn you an annualized return of 4.31%. If you’re willing to extend a bit further, a 1-Year T-Bill will yield 4.50%. Compare that to the 0.22% and 0.40%, respectively, you would’ve earned had you bought at the start of the year.

Beneficial Tax Treatment

Treasuries are also tax advantaged. Interest is subject to federal income tax but is free from state and local income taxes. On a tax-adjusted basis, we believe select Treasury yields are now as or more attractive than yields on other fixed income options with similar maturities, like high quality corporate bonds.

The Price Risk of Treasuries

Despite their “risk-free” label, the trading of Treasuries is not riskless. Unlike other short-term investment options like high yield savings accounts, Treasuries are securities that can fluctuate in price. T-Bill prices change daily alongside interest rate sentiment. If the market believes rates will rise, T-Bill prices will fall. If the market believes rates will fall, T-Bill prices will rise. Bond prices and bond yields have an inverse relationship.

That being said, T-Bills will always mature at face value. Aside from the unlikely event of a U.S. government default, an investor in T-Bills will earn back their initial investment plus interest if held to maturity. Thus, we recommend investors considering T-Bills do so only if they would be comfortable holding them to maturity.

Final Word

The menu of options for investors looking to park their cash in the short-term has grown recently. Among the options, we believe T-Bills are compelling given their enhanced yield and “safe asset” characteristics when held to maturity. Please consult with an experienced financial advisor to determine whether this strategy is appropriate for you in the context of your broader financial plan.

Read More from Saugatuck Financial