Many people have a tough time deciphering the difference between politics and policy and their effect on investing. With the new administration deep into its first year, it’s important to recognize the difference between politics and policy and how that difference can affect your investments.

The simplest way to describe the difference is to understand that one is words and one is actions. Politics can certainly affect an investment; however, it’s a concept that usually describes something that is short-lived.

As an example, during her presidential run, back in September of 2015, Hillary Clinton talked about doing something about the enormous consumer costs of pharmaceuticals. The markets took note: That month, according to the financial research company FactSet, the pharmaceutical exchange-traded funds PJP, IHE and XPH were down by anywhere from 11 percent to almost 19 percent.

Clinton also talked about filing legislation, punishing and changing the pharma industry. This, undoubtedly, was a populist push for votes, accompanied by a lot of political posturing; but, no actions were taken and the industry rebounded back to its previous vigor within months.

Subsequently, according to FactSet, for the fourth quarter that year, for those stock ETFs, values were up from 10 percent to almost 17 percent. Politics disrupted the pharma market in the short term, but also presented an opportunity for investors sitting on the sidelines.

Like all industries, the proof is in the pudding and pharma companies were still making lots of money, and recovered. You’ve seen this type of behavior occur in the market on many occasions, including the current North Korea war of words, which spooked the markets for about a week but then saw the markets rebound once people stopped worrying.

In other words, when it comes to investing, politics affects the short term, not the long term.

Policy, on the other hand, does affect markets. Unlike politics, policy entails legislative action, not just words, and legislation will affect the longer-term outcome in the markets. The effects are usually quite long-lasting and can be estimated based on real data rather than pure speculation about outcomes.

It is always important to remember not to give too much credence to the politicians.

Policies like the New Deal under Franklin D. Roosevelt’s administration are still being felt today. And, in 1980, when our country was coming out of hyperinflation and low growth, President Ronald Reagan came into office and by 1982 had passed a huge tax cut. That policy action put more money into the hands of consumers, which in turn pushed the equity markets higher for well over a decade.

Yet, policy can do long-term damage, as well. Consider then-President Richard Nixon’s decision to take the United States off the gold standard, in late 1971. All of the promises, allowing the Federal Reserve to control monetary policy and ensure fewer recessions, were, needless to say, incorrect.

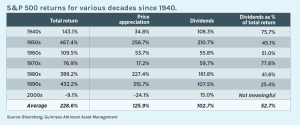

The result? Our currency was devalued, and what ensued was hyperinflation and high unemployment. The 1970s stock market, in fact, produced what was then the worst decade for returns since 1940 (with the exception of the dot-com period in the early 2000s).

Throughout history, then, we have seen many examples that prove that policy affects long-term investing, and that politics affects the short term. As an investor, you need to distinguish between politics and policy and take appropriate actions that will help with your asset growth. When investing, it is always important to remember not to give too much credence to the politicians. If you follow that advice, you should do well.