Each summer I spend time travelling on my motorcycle throughout the United States. This summer, I will embark on an ambitious 5,000-mile journey from Key West, to Fairbanks, Alaska. My three companions and I will travel through 12 states and four Canadian provinces. Needless to say, we’ll rely on good maps and GPS to guide us to our destination. Similarly, my team and I at Morgan Stanley help guide clients to their financial destinations by utilizing a goals-based wealth-management process. The “funding ratio” lies at the center of our guidance, as it represents a client’s progress toward his or her investment goals.

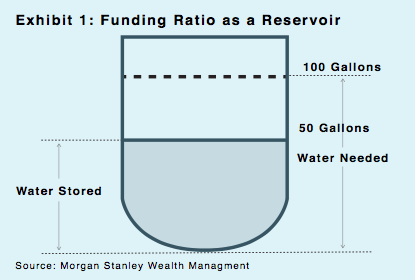

For example, an investor who’s accumulated half of what’s needed to cover planned spending would have a 50 percent funding ratio, assuming no additional savings. In that sense, think of a funding ratio as filling up a reservoir (Exhibit 1), except that instead of measuring water relative to capacity, the funding ratio measures financial resources relative to an investor’s spending plans.

A funding ratio changes over time as the markets fluctuate and investors revise their plans. Even for those in good financial health, the ratio can change quickly, and often does. The same 50 percent ratio, for example, may signal strong financial health—or deep financial distress.

The funding ratio represents a client’s progress toward his or her investment goals.

The deciding factor is whether the ratio is expected to rise in the future and by how much, a dynamic that depends most heavily on the length of time until the funds are needed.

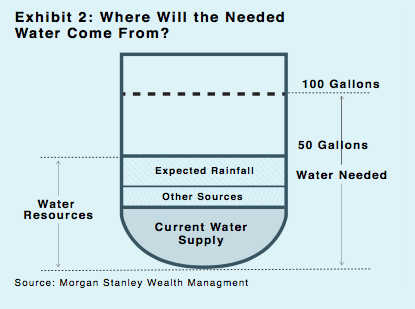

Funding ratios tend to increase as time passes, until the moment when spending is to occur, at which point, they typically plateau. To interpret a funding ratio requires understanding how it’s calculated. Exhibit 2 shows the sources of the funding ratio. Instead of assuming the reservoir is half full of water, let’s call it one-third full (the “current water supply”).

In this example, the water already in the reservoir is analogous to an investor’s current portfolio. The water to be sourced elsewhere is analogous to, say, expected social security or company pension benefits, plus other income streams. The “expected rainfall” represents the portfolio’s appreciation over time, to which we assign a conservative investment rate of return (ROI).

The importance of the ROI to the funding ratio explains how it can be used to help investors understand the implications of their investment decisions. If an investor with 10 years until retirement and a 70 percent funding ratio is conservatively invested, his investment performance may mean he’ll need to: boost savings, postpone retirement or trim spending to reach his goals.

Conversely, if he accepts more risk, the potential growth of his investment portfolio may create a smaller deficit and the need for less drastic remedies. The funding ratio helps investors achieve their goals and points them in the right financial direction. It’s just like the maps I’ll use this summer to reach Alaska by motorcycle.

The Fiamma, Kochman, Rubiano Group are a wealth advisory team with the Wealth Management division of Morgan Stanley in Boca Raton, FL. The views expressed herein are those of the author and may not necessarily reflect the views of Morgan Stanley Smith Barney LLC, Member SIPC [www.sipc.org]. Morgan Stanley Financial Advisors have engage Worth to feature this profile. They may only transact business in states where they are registered or excluded or exempted from registration [http://brokercheck.finra.org/Search/Search.aspx]. Transacting business, follow-up and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where they are not registered or excluded or exempt from registration. The strategies and/or investments referenced may not be suitable for all investors. Morgan Stanley and its Financial Advisors do not provide tax or legal advice. Individuals should seek advice based on their particular circumstances from an independent tax advisor. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the US. Investment Management Consultants Association, Inc. owns the marks CIMA®, Certified Investment Management AnalystSM (with graph element)®, and Certified Investment Management AnalystSM. CRC 1823870 07/17