No one can predict what is going to happen in the investment markets. Even Warren Buffett, perhaps the greatest investor of all time, implores investors to stop trying to predict the direction of the stock market, the economy or elections.

And, as it turns out, it is actually unnecessary to try to predict the direction of the markets, because what happens in the markets should never affect an investor’s life. But how can this be possible? The S&P lost 50 percent of its value in the recent Great Recession. And in that same decade, NASDAQ lost nearly 80 percent of its value after the bursting of the “tech bubble.”

Then there is the Chinese stock market, which has gained more than 100 percent on eight separate occasions during its relatively brief history. So, shouldn’t investors change their plans based on the impact these wild market swings could have on their portfolios?

Our job as your advisor is to develop a plan that accounts for the events that cannot be predicted.

Our answer is an emphatic no. Whether the time frame was the Great Recession of 2008–2009, the bear market of 2000–2002 or even the choppy markets of early 2016, we have fielded the same inquiries from current and prospective clients, including:

- Do I need to change my spending?

- Do I need to change my retirement plans?

- Will this impact the legacy I will be able to leave for my family and charitable interests?

As we tell all of our clients, in both great times and bad ones, our job as your advisor is to develop a plan that accounts for the events that cannot be predicted.

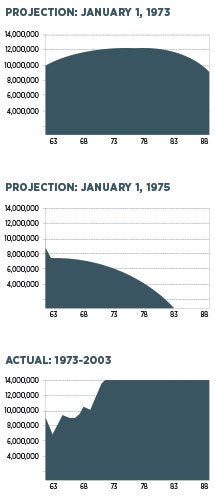

An interesting example of this is illustrated in the three charts to the right. Advisors use these cash-flow projections to help clients decide when they should retire or to help set appropriate spending levels.

The first two charts were predictive projections run in 1973 and 1975, respectively, to help a client determine if he or she had enough portfolio assets to support a particular lifestyle. As you can see, a very different picture was painted before and after the bear market of the early 1970s.

The third chart is what the client actually experienced with an appropriate portfolio. An advisor using these projections and counseling a client to change his/her lifestyle after the bear market would have been making a terrible mistake.

The moral of this story is simple: You should not have to change your lifestyle or your financial plans based upon bear markets, bull markets or anything in between. And, if you are receiving advice to the contrary, you might want to consider seeking new professional advice.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy or product (including the investments and/or investment strategies recommended or undertaken by Waldron Private Wealth), or any noninvestment-related content, made reference to directly or indirectly in this essay, will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this essay serves as the receipt of, or as a substitute for, personalized investment advice from Waldron Private Wealth. Waldron Private Wealth is neither a law firm nor a certified public accounting firm, and no portion of the essay content should be construed as legal or accounting advice. A copy of Waldron Private Wealth’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

This article was originally published in the June/July 2016 issue of Worth.