During the seven years between December 2001 and December 2008, the Federal Open Market Committee (FOMC) altered the target Fed Funds rate 28 times.

After lowering the rate, in December 2008, to a range of 0-0.25 percent, not a single attempt to raise rates occurred for the next seven years, as the Fed carefully assessed the fragile economic recovery. Finally, this past December, the long-anticipated process of raising interest rates began with a small .25 percent increase.

Many see this move as the start of a gradual but steady effort to ratchet rates higher as part of a longer-term monetary-tightening policy. But what exactly will that mean for your investment portfolio in general, and your fixed-income holdings in particular?

A HISTORICAL PERSPECTIVE

While conventional wisdom assumes that rising rates are generally bad for investors, past performance indicates otherwise.

Historically, despite short-term periods (months or quarters) during which bonds struggled in rising-rate environments, over a full market cycle of rising rates both equities and fixed income have experienced consistently positive returns.

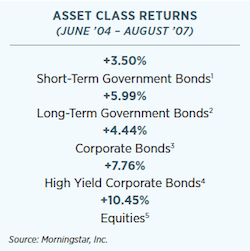

The most recent example is the extended 38-month rising-rate environment between June 2004 and August 2007. During that period, the Fed undertook a gradual tightening of the loose monetary policy enacted in response to 2001’s dotcom-related recession. From a starting Fed Funds interest rate of just 1.0 percent, the Fed implemented 17 successive quarterpoint rate hikes, eventually reaching a peak 5.25 percent.

How did fixed income and equity asset classes hold? Remarkably well, as the table below illustrates:

Similar results hold true over the four previous rising-rate periods. Clearly, rising rates do not necessitate negative returns.

PACE OF CHANGE IS WHAT MATTERS

More than the direction of change, the pace of interest-rate movement is what investors should pay attention to. While a sharp increase in rates over a short period will likely lead to negative returns, incremental increases over a longer period have far less market impact. Based on recent events, the Fed’s latter cautious approach is its intended course.

Keep in mind that rising rates typically indicate an improving economy. Corporate profits are on the uptick, which translates to higher stock prices, so equities generally perform well. Even on the bond side, there are active portfolio-management strategies that mitigate the negative impact if rates start rising quickly.

What makes sense? Keep your bond maturities shorter. Look for higher-coupon bonds with shorter durations, not longer-maturity government bonds. Talk to your advisor about increasing your allocation to high-yield corporate bonds and/or floating-rate bonds, where interest rates regularly adjust to lessen the impact of rate increases. Look closely at global bonds, too, since many foreign countries are behind us on the interest-rate cycle.

Finally, explore long-short bond strategies. There are funds designed to do well in a rising-rate environment. Above all, strive to be an attentive rather than reflexive investor, as interest rates move higher. By being proactive and making adjustments, you can use the environment to your advantage.

1 Barclays U.S. Government/Credit 1-to-3 Year

2 Barclays U.S. Long Government/Credit

3 Barclays U.S. Aggregate Bond

4 Barclays U.S. Corporate High Yield

5 S&P 500

Registered Representative/Securities offered through Signator Investors, Inc., member, FINRA/SIPC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067. Signature Estate & Investment Advisors, LLC and its investment advisory services are offered independent of Signator Investors, Inc. and any subsidiaries or affiliates. This article is for informational purposes only and is not intended as individual investment advice or as a recommendation of any particular security, strategy or investment product. No investment strategy can guarantee a profit or protect against a loss. Indices are unmanaged and cannot be invested directly. Past performance does not guarantee future results. Investing involves risks and possible loss of principal capital.

This article was originally published in the April/May 2016 issue of Worth.