A consistent gift program is the best way to whittle down estate taxes. Financial advisors encourage making gifts to freeze estate values and push appreciation down to lower generations. Yet, parents are reluctant to do so for fear of witnessing their wealth dissipate or fall into the wrong hands.

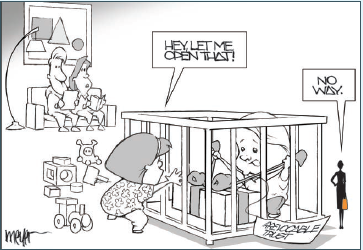

So, how do you make a gift when you want its future appreciation to be available for a child’s use and at the same time be protected from creditors or claims from a child’s spouse? The answer: Wrap it in an irrevocable trust.

An irrevocable trust sounds ominous, but it is your best friend. Regardless of how a gift is structured, and whether the child can benefit from it immediately or only after the passage of time, the property should be kept out of a child’s name.

Instead, the title should be held in an irrevocable trust as a shield. Gifts are precious. You have a limited lifetime federal transfer-tax exemption of just under $5.5 million (which is the current amount, and is indexed for inflation), with a tax rate of 40 percent over that exemption.*

When you use any portion of this exemption, you must report the gift. Then, at your death, your federal estate-tax exemption is reduced accordingly. Unlike what happens with an inheritance, you’ll be around to watch how it is used. Often, estate plans are modified based upon a child’s actions resulting from a lifetime gift in trust. The trustee controls the gift, and if all goes well, the child can become co-trustee or sole trustee at a designated age. But, without an irrevocable trust, any gift is exposed to the possibility of being commingled and subject to claims.

The trust allows for ease of management and the ability to control fractional ownership.

Advisors can offer various sophisticated gifting strategies, such as grantor retained annuity trusts, insurance-based trusts, charitable lead trusts and qualified personal residence trusts, which utilize irrevocable trusts to leverage the use of the lifetime exemption.

These trusts delay the recipient’s use of the gift, to achieve a tax benefit, but if they are not thoughtfully drafted, property can fall unprotected into the hands of the donee once these trusts terminate.

Even simple gifts, such as adding the children’s names on the deed to a vacation home, can benefit from an irrevocable trust. The trust allows for ease of management and the ability to control fractional ownership.

So, make that gift in the form of an irrevocable trust. By putting a barrier around the property, the trustee controls the wealth; the nature of a gift is not transmuted; ownership and appreciation are traced; creditors are barred; and, in some instances, estate tax at the recipient’s death can be avoided. My advice: You should never present a gift “unwrapped.”

*Incidentally, there are certain transfers that are excluded from being considered a gift for tax purposes, and so are not reported. They include gifts between U.S.citizenspouses, annual exclusion gifts—currently $14,000 per recipient each year—and unlimited amounts for medical and tuition payments made directly to the service provider or institution. There are special tax rules for making these transfers into irrevocable trusts..

This article was originally published in the December 2016/January 20167 issue of Worth.