Shortly after Congress passed the new tax bill that was signed into law on December 22, 2017, a respected United States (U.S.) business journal put a writer to work explaining the new “simplified” tax code. The writer required 2,172 words to accomplish that task and ultimately ended the piece on a somewhat wry note, asking, “Remember when we thought this was going to be simple?”

No criticism is intended here. For decades, candidates of every political stripe have promised to make paying taxes simpler, if not simple. And to our knowledge, none have succeeded. Nevertheless, as of last December, we have a new tax code, and one that needs review. Still, since we have just 600 words to complete our review, we will focus on only one revised area of taxation: foreign business income.

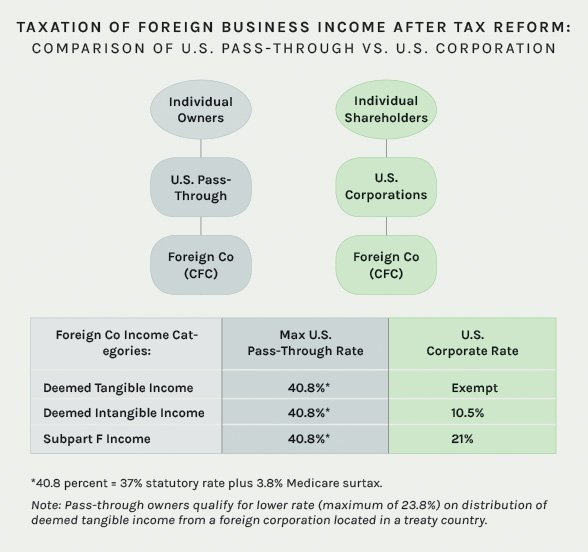

So, what has changed? While the new tax code has lowered the rate on income from a foreign business, how that business is held in the U.S. now further affects the new rate you will pay. Many U.S.-owned foreign businesses are held on the U.S. side by a pass-through entity (i.e., sole proprietorship, partnership, LLC or S corporation). Others are held by domestic corporations owned by one or more shareholders.

Regarding the new tax law, it is important to remember that with a U.S. pass-through business, the income of the business is regarded as the income of the owner/partners. That is, the income of the business “passes through” the business entity and is taxed only once at the owner level. With a corporation, the income of the business is taxed first at the corporate level, and then, shareholders incur a second level of tax on the receipt of dividends or capital gains.

Pass-throughs gradually gained favor among business owners in part because corporations were taxed twice, at the corporate and at the shareholder level. With the reduction in individual tax rates following the Tax Reform Act of 1986, the use of pass-throughs became a slam-dunk decision.

But things have changed since last December, and while we’ll guess that you know whether your foreign-owned businesses are owned by a U.S. pass-through or corporation, if you don’t, now is the time to check. Now, based on the new tax law, is also the time for you to rethink the structure of your foreign businesses if indeed they are operated by a U.S. pass-through.

To further explain, let’s take a look at the chart on the opposite page titled “Taxation of Foreign Business Income after Tax Reform.” As shown in the illustration, the new law now splits the income of controlled foreign corporations (CFCs) into three categories.

Individuals who hold a foreign corporation directly or through a U.S. passthrough entity are taxed at 40.8 percent on all three categories of CFC income. Domestic corporations, meanwhile, are taxed at rates between 0 and 21 percent. Although there is an additional tax of 23.8 percent when the domestic corporation distributes earnings to individual shareholders, the corporate form still provides significant benefits, especially if the earnings are reinvested at the corporate level.

Of course, as the saying goes, every situation is different, and your case or cases will need to be modeled out for the maximum benefit. But, at the very least, we as your advisors will strongly urge you to revisit the structure of those foreign businesses and see if indeed it is time to swap out that pass-through for a corporation.