Alternative investments (known simply as “alternatives”) are investment strategies outside of traditional stocks, bonds and cash.

Some common examples are private equity, venture capital, hedge funds, real estate, commodities and currencies. Less obvious examples are managed futures, private debt, derivatives and strategies such as hedging, short selling and arbitrage.

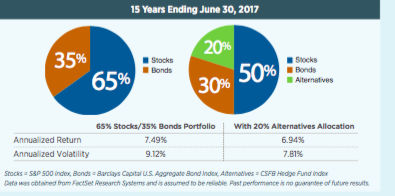

The popularity of alternatives has surged in the years following the 2008 financial crisis. Market volatility and rising interest rates have made the traditional 65/35 allocation to stocks and bonds feel less secure. Subsequently, investors have looked to further diversify their portfolios; and alternative investments provide a good solution, to potentially increase returns and/or decrease risk. (See chart.)

One reason for incorporating alternatives into your investment strategy is to build a diversified portfolio whose more consistent return pattern will better withstand the fluctuations in market cycles. Alternatives help to achieve this goal primarily through risk reduction and the generation of strong returns that are often less correlated with traditional equity and bond markets. Correlation refers to the degree to which investments fluctuate relative to one other. Positively correlated assets move in the same direction.

Alternatives, being less correlated to traditional markets, may exhibit returns that go up when equity and/or bond markets go down, and vice-versa. Alternatives also exhibit strong defensive characteristics despite the perception that they can be riskier assets. Referencing the concept of correlation again, the lower correlation of alternatives to traditional asset classes helps to reduce risk.

Market volatility and rising interest rates have made the traditional 65/35 allocation to stocks and bond feel less secure.

Assuming equal levels of risk for an alternative versus a traditional asset class, the mere addition of low correlated assets increases a portfolio’s diversification and, therefore, reduces its risk.

Further, from a statistical standpoint, alternatives often have much lower down-market capture ratios (a measure of an investment manager’s overall performance in down markets) than traditional asset classes, meaning they often produce better returns when markets are declining.

Historically, alternatives have been relatively difficult to access due to large investment requirements, strict prequalification rules, higher fees, lower liquidity levels, long lock-up periods for invested capital, poor transparency and difficult valuation.

Also, though formerly available only to institutional investors, alternative investment strategies have become more accessible to the individual investor due to a proliferation of more liquid and tax-friendly alternative investment structures, such as REITs (real estate investment trusts) and MLPs (master limited partnerships), which can be easily accessed via ETFs (exchange-traded funds), actively-managed mutual funds or closed-end funds.

Because today’s complex markets require sophisticated investment techniques to help investors achieve their long-term goals, we believe alternatives can play a key role in a successful investment experience.