In June, the U.S. Federal Aviation Administration certified a new kind of aircraft. Joby Aviation’s vehicle rises straight off the ground on six electric-driven propellers, which gradually pivot forward until the craft is flying like an airplane; the process reverses for landing. Hence the wonky term for such a vehicle: eVTOL, for electric vertical takeoff and landing. Battery powered, Joby’s five-seat craft promises to be greener and cheaper to operate than traditional planes and helicopters, and—significant for Joby’s ambitious expansion plans—far quieter for the neighbors.

Wall Street rejoiced at the news, which bolstered Joby’s promise to launch passenger service by 2025, pushing its stock up about 60%. (It’s since fallen.) The company’s market cap was about $5.9 billion as of this writing.

Joby’s neck-and-neck rival, Archer Aviation, targets the same timeframe with its Midnight 5-seater. (The company hit a market cap of about $1.7 billion over the summer, bolstered by a deal with the US military.) “They’re both very well positioned with good cash reserves,” says Evan Deahl, engagement manager at Alton Aviation Consultancy. The two head a pack of other generously funded startups (and many more fledglings), including Eve Air Mobility and Boeing-owned Wisk Aero in the U.S., Lilium and Volocopter in Germany, and EHang in the PRC. (Wherever they are based, these companies have global ambitions.)

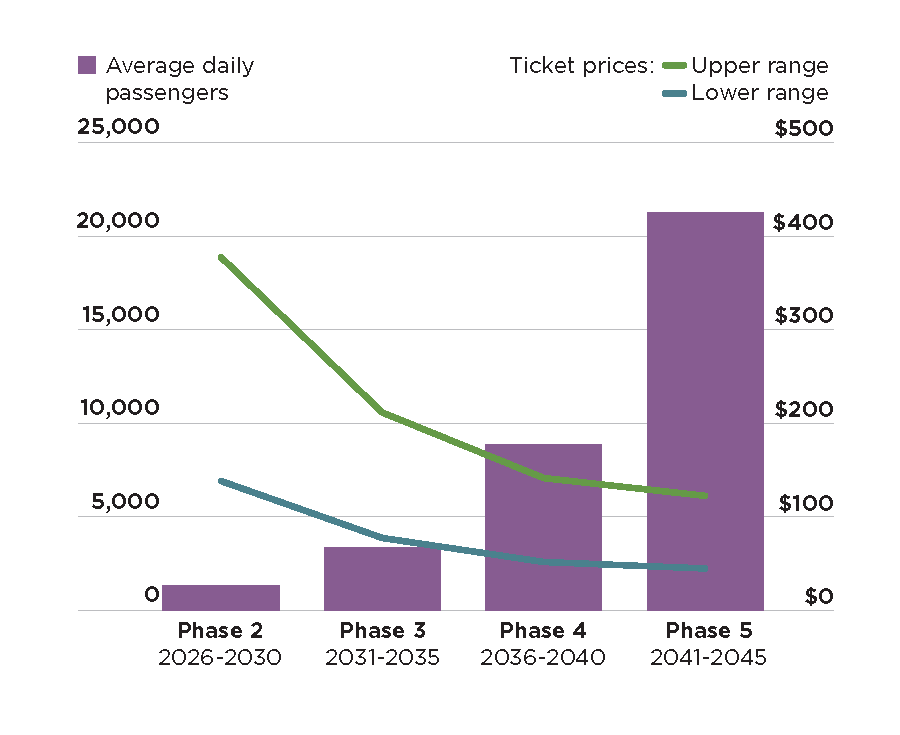

All plan to fill the skies with aircraft as affordable to ride as Ubers. (Uber once had its own air taxi program, which it sold to Joby in 2020.) But there’s still a lot to accomplish before 2025, when eVTOLs will, at best, nibble at the semiprivate helicopter market. Reckon on roughly $100 to $400 tickets, depending on the flight.

“Certainly, for the first few years, perhaps decades, it’s gonna be an expensive service,” says Jonathan Geurkink, senior analyst for emerging tech at capital markets research firm PitchBook. “I think it’s going to be pretty limited to who’s flying these things, who can afford to fly these things.”

Launching a company like Uber or Lyft required only putting mass-produced cars with plentiful, already-licensed drivers onto an existing transportation network, using a smartphone-based dispatch system that doesn’t require regulatory approval. None of that’s true for electric air taxis struggling to reach economies of scale.

Approval Takes Time

Joby’s latest certification wasn’t a go-ahead for final passenger service but only for flight testing the production prototype of its to-be-named aircraft. There are several more steps to commercial service, and the route has just changed. The FAA had planned to certify eVTOLs as small airplanes under a regulation called Part 23. But last year, it switched to instead require certification as “powered-lift” vehicles to account for their vertical ascent and descent. “There’s actually never been a civil aircraft certified under that category before,” says Deahl.

Despite the added challenge, he thinks the most prominent players can pull it off by 2025. “Joby and Archer, they’re both very well positioned with good cash reserves,” he says. (Deahl says that Alton does not consult with any of the companies mentioned in this article, but it works with competitors he declined to name.)

Other industry watchers are not so sure. “The aircraft business tends to be very incremental,” says Geurkink. “We change one little thing, add one little bit of innovation, and get it certified.” Instead of tweaks to tried-and-true airplane and helicopter designs, air taxi companies are trying to push radically new technologies through the certification process.

Eve Air Mobility has announced high-profile sales agreements for nearly 3,000 aircraft with operators, including United Airlines and helicopter and plane charter broker Blade. It’s promising service-ready craft by 2026 but is still building its first full-scale prototype. (Joby did that in 2017, and Archer did just in May.) Wisk Aero is planning to launch once its planes can fly autonomously. The company says it will begin service by 2030.

Launching a company like Uber or Lyft required only putting mass-produced cars with plentiful, already-licensed drivers onto an existing transportation network, using a smartphone app.”

Going pilot-free is the ultimate ambition for all these companies. Autonomy eliminates a salary, makes room for another customer, and solves the pilot shortage problem. Michael Dyment, founder and managing partner at NEXA Capital Partners, expects autonomous tech to be ready in 2030, at best. (Dyment says that NEXA invests in about half the companies covered in this article but would not reveal which ones.) Meanwhile, today’s licensed helicopter or airplane pilots can’t just drop into an eVTOL. Deahl says they need to get certified for this “powered lift” class of aircraft.

Infrastructure Barely Exists

Even FAA-approved aircraft and pilots still need somewhere to fly from and to. “[Infrastructure is] much further behind where the eVTOL [manufacturers] are,” says Dyment. In cities today, it’s limited to a few helicopter ports.

New York City is the nightmare scenario. Building more heliports, or “vertiports,” as eVTOL boosters call them, for crosstown travel faces the challenge of crowded airspace, scarce real estate, high construction costs, and a surfeit of lawyers poised to file noise complaints. (Joby has demonstrated its craft as being not much louder than a boisterous conversation on take-off, but that’s different from the popular perception of aircraft.)

New York does have several heliports along the water that already support shuttles to and from its far-flung airports. Many other cities also have these helicopter services, and electric aircraft could be a drop-in replacement. “It looks like these eVTOL [makers] have settled on airport transfer as the launch use case,” says Deahl. “It’s hard to make the unit economics work in other use cases.

Joby is partnering with Delta Airlines for likely airport shuttle service in New York City and Los Angeles. Archer is teaming with United Airlines for New York City and Chicago. They have yet to mention prices. But helicopter shuttles on Blade in New York start at $195 one way. (Blade, which operates worldwide, has announced plans to employ eVTOLs from Eve.)

Los Angeles is better prepared. “There’s a lot of existing heliports,” says Dyment, “and more tolerance to helicopters because LA and the whole county are used to seeing and hearing helicopters.” Seattle and Vancouver, where people suffer slow commutes by boat, are also receptive, he says. A company called Helijet, for instance, offers traditional commuter flights in the Vancouver area.

NEXA completed a study of 42 U.S. metro areas in March. “In most cities that we’ve looked at, you can find selected market opportunities,” says Dyment, meaning helipads or airports in suitable locations. “It’s a small number. But from the standpoint of launching revenue businesses in 2025, there are those types of opportunities.”

And some new sites will get built in the next two years. “We’ll probably put funds in by the end of this year to build a number of heliports in a metropolitan area,” says Dyment, declining to reveal which one. Building an entire national infrastructure will take 15 years, he estimates.

EVTOL companies used to call their business “urban air mobility,” but this tech could find success in the suburbs and countryside. (Proponents now call it “advanced air mobility.”) “Let’s say you want to go from someplace in New Jersey to someplace in Connecticut,” says Dyment. “You don’t need to fight the fight in Manhattan to find commercial promise in the surrounding areas.”

Air taxis could extend farther out, says Darryl Jenkins, former director of The Aviation Institute at George Washington University, citing a prime candidate. “So Stafford, Virginia—to get to [Dulles] airport, it’s a two-hour drive through traffic, whereas with an air taxi, it’s a 20-minute drive over traffic.”

Battery capacity becomes an issue at some point, but plenty of routes are short enough for today’s technology, says Jenkins. Archer claims a range of 100 miles per charge for Midnight; Joby has demonstrated 150 miles.

Economics could be a more significant issue. “There’s a lot of talk about launching eVTOLs on regional routes, like serving [communities] that maybe have lost air service,” says Deahl. “But ultimately, they’re going to need to launch these in places where consumers can afford to pay the higher prices per ticket.”

Several eVTOL companies have also clinched deals with delivery companies and the military. In July, Archer announced a $142 million agreement with the U.S. military to provide up to six aircraft, plus pilot training and a maintenance and repair program, among other services.

Infrastructure isn’t just built of steel and concrete. Flying cars need a new air traffic control system to go big. In their first years, eVTOLs will follow the existing rules for helicopters. This restricts them to higher altitudes and bigger distances between aircraft than they’d need to achieve max efficiency, says Dyment.

“Ultimately, what they want to do is bring in some more autonomy to the system,” says Deahl,” so that the vehicles can communicate with each other and on the ground so that you can put more traffic in the air.”

Such a system has to be approved and implemented by the FAA. But the agency is already behind and over budget on updating traffic systems for today’s aircraft. And it’s smarting from high-profile goofs, like a computer crash that grounded flights nationwide in January.

“The U.S. Congress is not willing or interested, really, in giving the FAA billions of dollars to build out low-altitude air traffic control,” says Dyment, “because the FAA is behind, some say 20 years, in terms of modernizing its existing air traffic control program.” NEXA estimates that such a system for eVTOLs would cost about $3.8 billion for the 42 markets it studied.

In June, the U.S. Department of Transportation’s Office of Inspector General issued a report criticizing the FAA’s “regulatory gaps and lack of consensus” on air taxis—especially the sudden switch to requiring “powered lift” certification and slow progress defining what that means for pilots. However, the FAA had put out an updated “blueprint” in May that clarified its thinking on many issues.

Bureaucratic backlogs and the uniquely fierce infighting between government entities and interest groups could cause the U.S. to fall behind, warns Dyment. “Europe is like a crucible for competition because countries like Italy are competing with France and the U.K. to bring advanced air mobility sooner.” Italy is promising to bring electric flight to the 2026 Milano Cortina Olympics (as is LA for the 2028 games). China, Japan, and South Korea are also moving aggressively, says Dyment. In Saudi Arabia, “the royal family decides what safety regulations are important,” he says.

A Luxury Service for Years

If you can afford the hundreds of dollars for a shared helicopter ride today, you’ll be able to afford an eVTOL in 2025—or whenever they launch. If you can’t, or don’t want to, pay those fees, it will be a while. “There are lots of trending things that would lead us to believe that the price of a ticket in 15 or 20 years would be similar to what you’d pay for an Uber,” says Dyment.

The U.S. Congress is not willing or interested, really, in giving the FAA billions of dollars to build out low-altitude air traffic control.”

In its study for markets in Virginia, NEXA estimated average prices across three use cases—on-demand air taxi, airport shuttle, and regional transport. They range from about $140 to $380 (one way) in 2026. By 2045, the high-low range drops to about $45 to $120.

That long ramp-up dampens environmental promises for green-powered aircraft. “[Given] some of the numbers of production that the companies…have talked about…you’re not going to offset millions of cars that go into LA every day, and back and forth, with 10,000 or 20,000 air taxis,” says PitchBook’s Geurkink. Electrifying cars will be a much bigger green factor.

Even cautious investors see an ultimate payout. NEXA forecasts that air taxis will eventually be a trillion-dollar business. But it will take years, and pain.

“I have no problems believing that at a certain point, this will become a big product and a big, big market,” says Darryl Jenkins. “Getting from this point to that point, we’re going to see a lot of invested capital go bankrupt, and a lot of good ideas [fail]…These are just the kind of things you expect in a new industry with a lot of players.”