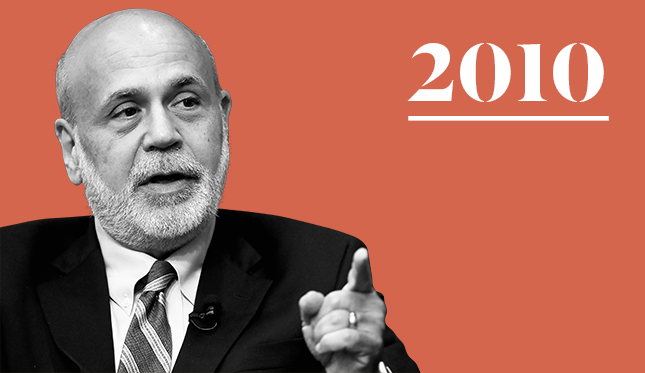

The former chairman of the United States Federal Reserve topped the first Power 100 list in 2010. Here, Worth looks back at his path to power, the power play that landed him in the top spot and where he is now.

WHAT WE SAID THEN

Path to Power: A graduate of Harvard College, Bernanke earned his economics PhD from MIT and taught at Princeton for some 20 years—he specialized in the causes of the Great Depression—before becoming a member of the Fed board of governors in 2002. In 2005, he became chair of George W. Bush’s Council of Economic Advisers, and in January 2006 Bush appointed him Fed chair. Amidst debate over the Fed’s role during the crisis of 2008, his 2009 re-nomination by Barack Obama led to a contentious Senate confirmation vote of 70-30.

Power Play: Ben Bernanke is the most powerful financial figure in the United States, and for the immediate future anyway, that means he is the most powerful financial figure in the world. So it is not surprising that debates and concerns over his power have been growing. His response to the economic crisis has

WHERE BERNANKE IS NOW

Since leaving the Fed in 2014, Bernanke has become our best witness to exactly what happened during the Great Recession. He became a distinguished fellow at the Brookings Institution, where he writes a blog on economics, finance and policy. In 2015, he published a memoir, The Courage to Act: A Memoir of a Crisis and Its Aftermath. And in April of this year, his Firefighting: The Financial Crisis and Its Lessons, coauthored with former Treasury secretaries Henry Paulson and Tim Geithner,