With all of the uncertainty about where estate and gift tax law is headed, now is the perfect time to focus on an issue unaffected by federal tax laws: trustee selection.

You spend your life accumulating, preserving and growing your wealth— who do you want to stand in your shoes when you can no longer act? A document can only go so far to protect your family and property; it is up to the trustee to implement the plan.

The “perfect” trustee, of course, is you. So, what should you consider when picking a trustee to act for you? From years of drafting and administering gift and estate plans, I can offer a few novel suggestions to guide you in making this important choice.

1. Divide and conquer: different trustees for separate trusts. Instead of naming a trustee to handle all of your property, consider a plan that segregates trust assets in various trusts with different trustees. For example, certain real estate, like family and vacation homes, is better suited for family members as trustees.

Venture fund interests, closely held stock or family business assets, on the other hand, require personal knowledge of the unique corporate environment, as compared to the skills required to manage a stock portfolio.

2. Share the road: co-trustees. It used to be an honor to be selected as a person’s trustee. Now, it is a time-consuming obligation, and one in which fiduciary responsibility may be raised as a weapon by a disgruntled beneficiary. The alternative of “two for the job” is sometimes overlooked as an alternative for clients.

Co-trusteeship allows one trustee to provide financial savvy and the other to maintain a close personal connection with the beneficiaries. The combination of a corporate trustee and an individual one is often ideal. Requests for discretionary distributions can be handled in an objective manner, and checks and balances instituted to help protect trust assets.

A document can only go so far to protect your family.

3. You get what you pay for: reward the trustee for taking on the task. A trustee is needed in the event of death or incapacity. You can no longer act to control things. This is not the time to get cheap and look for someone who will act for nothing.

4. The pivot: adding flexibility to the document. Most trusts are drafted to last for successive lifetimes, so it is best to provide for unforeseen circumstances. If you trust a person enough to name as your trustee, consider giving that person the right to alter the trustee succession, as well.

The power to remove and appoint trustees is an important power to include in a document to avoid the necessity of a court proceeding.

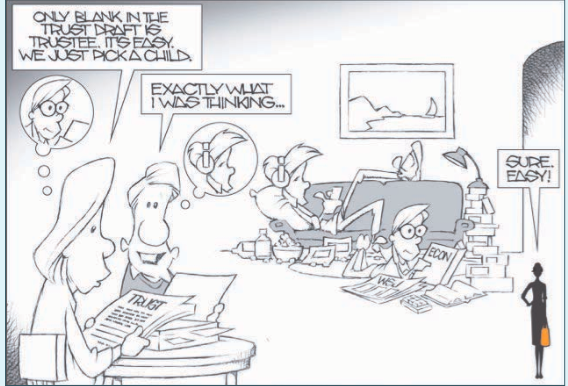

Overall, the trusteeship is important and often the hardest decision a client will make. Far from just being some names you insert in blanks, the persons or banks you chose as trustees require careful consideration.

So, recognize the importance of that choice: The success of your plan depends on them.

Incidentally, there are certain transfers that are excluded from being considered a gift for tax purposes, and so are not reported. They include gifts between U.S.citizen spouses, annual exclusion gifts—currently $14,000 per recipient each year—and unlimited amounts for medical and tuition payments made directly to the service provider or institution. There are special tax rules for making these transfers into irrevocable trusts.

This article was originally published in the February–April 2017 issue of Worth.