Company stock (equity) programs are additional ways for employees to be compensated. Numerous types of equity award programs exist; however, the most common are typically employee stock options and restricted stock.

EMPLOYEE STOCK OPTIONS

Employee stock options (ESO) are a form of compensation granted by companies to certain employees and executives. ESOs allow employees the right to purchase a certain number of shares of their company stock at a predetermined price, called the strike price, within a specified time period.

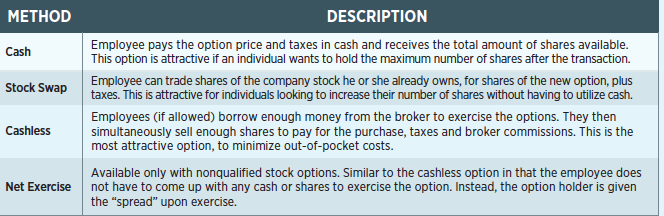

The “grant” date is the date an employer (grantor) gives an employee (grantee) the stock option(s). Typically, the fair market value (FMV) on the grant date is the strike price. Exercising a stock option occurs when employees purchase the stock at the strike price. (Please see Exhibit 1 for exercise methods.) The value of an option is found in the “spread,” or the difference between the strike price and the FMV of the stock when it is exercised.

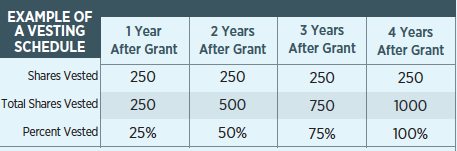

ESOs usually have a “vesting period,” meaning that employees granted stock options must wait before they can exercise the option. Most vesting schedules are cumulative; if employees were granted an option to purchase 1,000 shares, their vesting schedule would be:

The two most common types of stock option awards are nonqualified stock options and incentive stock options. The key difference is the tax consequence upon the exercise of the option.

RESTRICTED STOCK

Restricted stock or a restricted stock unit (RSU) award is compensation in which company stock is promised to employees at a future date and/or if certain performance goals are met. These awards usually require no out-of-pocket cash by the employee, and are assigned a fair market value when they vest.

Numerous types of equity award programs exist; the most common are typically employee stock options and restricted stock.

An individual may be granted 1,000 shares of restricted stock that vest over four years. Once vesting occurs, unlike with options, individuals receive 250 shares of the company outright each year (rather than an option to purchase them).

If the holding period and/or goal is not met, generally those shares are forfeited. It is important that employees review the terms of the award to understand what will happen if they terminate employment or fail to reach the specified goal. When the shares vest, the employee receives the shares of company stock or the cash equivalent. The value received is treated as compensation and is taxed as ordinary income. If an employee continues to hold the shares, his or her value of the shares on the vesting date will equal the basis for those shares.

COMPANY TRENDS

Employers have been granting more RSUs instead of stock options. This is possibly due to tax policies and accounting complexities involved with stock options. Companies are more able to forecast how restricted stock will impact their bottom line.

It is always important for employees to consult with a financial advisor or accountant regarding the diversification and tax consequence of selling or exercising their equity awards before they make any decisions.

This article was originally published in the February–April 2017 issue of Worth.